Macroeconomics and financial markets

In the US NY stock market on the 17th of the previous weekend, the Dow closed at $384 (1.1%) lower than the previous day and the Nasdaq at $86 (0.74%) lower.

connection:US stocks fall, dollar weakens Bitcoin returns to $27,000 level | 18th Financial Tankan

Amidst a series of bankruptcies in the United States, concerns about the management of Credit Suisse, a major financial institution, have risen sharply.

On the other hand, it was reported that Swiss investment bank UBS agreed to a huge acquisition of Credit Suisse, which led to the receding of concerns. In response to the US stock market decline, the Nikkei stock average continued to fall on the Tokyo stock market. Although the acquisition of UBS supported the lower price, there is deep-rooted concern about an economic recession, and the situation of selling ahead continues.

As the world continues to raise interest rates at an unprecedented pace, the bankruptcy and financial concerns of financial institutions that have become public are considered to be the tip of the iceberg, and a large amount of subordinated bonds AT1 issued by Credit Suisse The fact that bonds (approximately 2.2 trillion yen) have become worthless also has an inevitable impact on major investment management companies, and is thought to have worsened market sentiment.

connection:Swiss investment bank UBS agrees to buy Credit Suisse for $4 billion

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.15% from the previous day to $27,512.

BTC/USD daily

It briefly climbed above $28,300 and approached the 2021 bull market bottom of $28,800 before falling back.

On the 20th, the central banks of Japan, the United States, and Europe jointly announced a plan to “strengthen the supply of dollar funds.” Analysts at investment firm AllianceBernstein said the recent rally in cryptocurrencies was “due to a reassessment of risk profiles.”

Against the risk of such a financial crisis, the true value of Bitcoin, which was born in January 2009 after the Lehman shock, is being questioned.

The genesis block of bitcoin is engraved with the words “Chancellor on brink of second bailout for bank”, mimicking the headline of the British Times newspaper reporting “the central bank’s second bailout in financial crisis”. It has been seen as the “antithesis” to banks and traditional financial markets.

While the amount of legal currency is being printed in large quantities in various countries, the value of cash and bank deposits is relatively declining due to high prices due to inflation. It is easy to generate a flight demand for alternative assets such as

Among emerging economies, Argentina’s annual inflation rate has accelerated further from 55.1% as of March 2010. It surpassed 100% in February 2011, marking the highest price in 30 years. During the crypto market selloff in February this year, BTC fell 34% in dollar terms, while it rose 20% in Argentinean pesos. In countries where such economies and domestic currencies are extremely unstable, it is useful as an alternative asset.

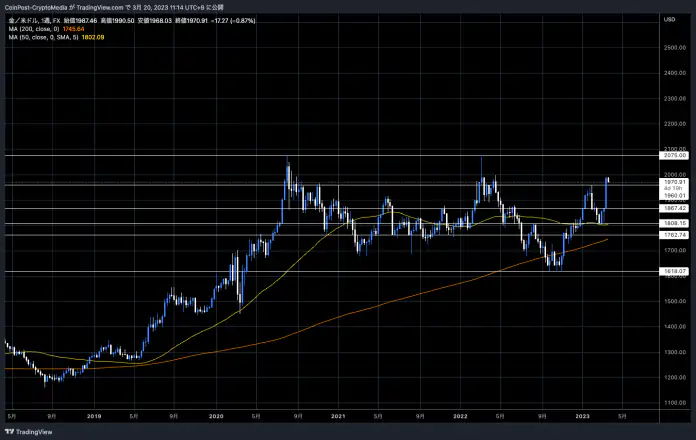

The bankruptcy of the US bank Silicon Valley Bank (SVB) and the financial instability of Credit Suisse have also had an effect, and the price of gold, which is considered a safe asset along with Bitcoin, is soaring. NY gold futures price rose to 1 troy ounce = $ 1988, surpassing the high of January this year.

gold price weekly

Some speculate that the US Fed’s pace of interest rate hikes will slow down and be halted, which is the main reason for Bitcoin’s rise. With the US Federal Open Market Committee (FOMC) coming up at 3:00 on the 23rd Japan time, there is a possibility that the wait-and-see trend will intensify.

At the next FOMC meeting, a rate hike of 25 bps is currently factored in by about 70% of the time. However, given the fact that rapid monetary tightening in order to “control inflation” has led to bank failures, “stabilization of the financial system” is a priority. However, at this point in time, we will be faced with an extremely difficult decision as to whether or not we should suggest a pivot (policy change).

connection:Bitcoin reversal rise due to US bank rescue, uncertainty about high inflation | bitbank analyst contribution

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

Bitcoin temporarily hits the $28,000 level, and gold soars due to global financial concerns appeared first on Our Bitcoin News.