Bitcoin is fighting to hold above the $33,000 but overhead pressure continues to make this task a difficult one for the bulls. The largest cryptocurrency had recovered after testing and confirming support at $30,000. However, overhead pressure at the 50 Simple Moving Average, marginally above $36,000 prevented further price action.

At the time of writing, BTC/USD is seeking support above $33,000 to avoid extending the bearish leg to $30,000. The 100 SMA is also a key level in the mission to avert the losses, perhaps reverse the trend for gains heading to $40,000.

The Relative Strength Index, reinforces the pessimistic outlook by diving under the midline. A stretch to the oversold region would encourage more sellers to join the market while the others increase their positions. If enough volume is created, BTC may break down to test the support provided by the 200 SMA on the 4-hour chart.

BTC/USD 4-hour chart

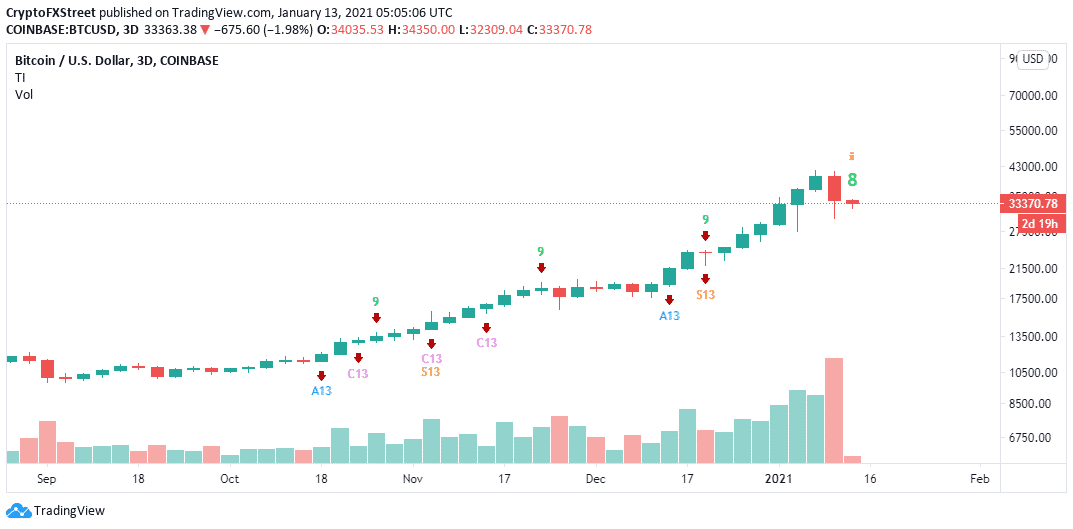

The TD Sequential Indicator may present a sell signal on the 3-day chart in the next few days. This call to sell will take the form of a red nine candlestick. If validated, Bitcoin price could correct further in one to four 3-day candlesticks.

A red two candlestick trading below a preceding red one candle could serve as confirmation that Bitcoin is poised to drop further.

BTC/USD 4-hour chart

According to the head of commodities research at Goldman Sach’s, Jeff Currie, Bitcoin’s “market is beginning to become more mature.” However, its volatility increases the risks of exposure. To bring down this volatility, Bitcoin needs more institutional money to stream in. Curries said on Monday that at the moment, Bitcoin has very little institutional backing, “roughly 1% of it (Bitcoin’s $600 billion) is institutional money.”

Bitcoin intraday levels

Spot rate: $33,362

Percentage change: -2%

Relative change: -688

Trend: Bearish

Volatility: Low