In October more than one million Unique Active Wallets (UAW) connected to game dapps every day, on average. Representing 55% of the blockchain industry’s overall activity. Riding the wave of booming interest in the metaverse, virtual world games are performing well, whereas established games like Axie Infinity and SPLINTERLANDS continue their strong performances. VCs are piling in, with more than $120 million invested into blockchain game-related platforms in October alone. While the Polygon network is emerging as a blockchain for gaming.

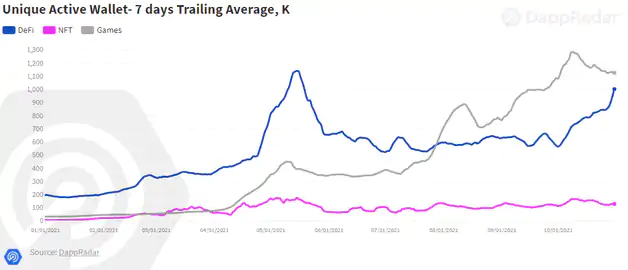

In October, the number of daily UAW connected to blockchain dapps reached an all-time high, surpassing more than 2 million UAW per day on average. Despite a strong surge in the use of DeFi dapps, the number of UAW connected to games still represents 55% of the industry’s total, keeping up the dominance shown in September.

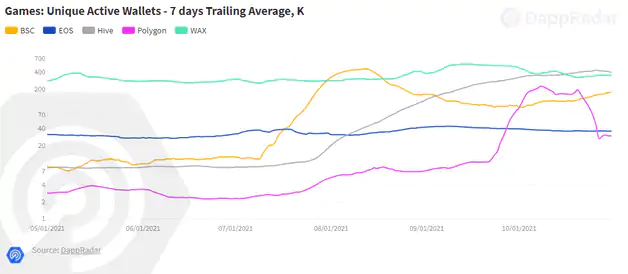

The positive usage trend spread across most networks that offer a game element. Surprisingly, Polygon showed the biggest growth, as the layer 2 solution increased its game usage by 322% month-over-month (MoM). Hive and BSC also experienced an uptick in their respective game activity. Splinterlands driving the former, while a combination of GameFi dapps supported the growing usage of the Binance-branded network.

On the other hand, we see a decline in the activity of two strong game-related blockchains, Wax and EOS. While games like Alien Worlds and Farmers World attract significant attention, the usage in the World Asset eXchange decreased slightly from the previous month. It should be noted that Alien Worlds launched its game Missions on BSC, showing positive results in the first days of November.

Key takeaways

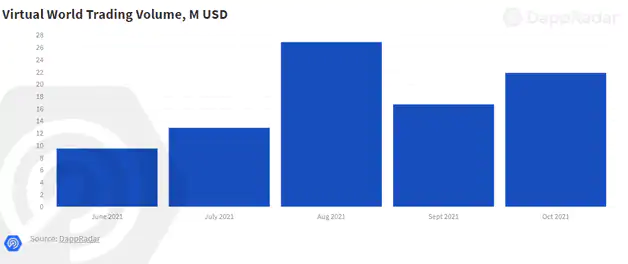

- 1.2 million Unique Active Wallets connected daily to blockchain games on average in October, representing around 55% of the blockchain industry’s activity. Trading volume related to game-related NFT items decreased 11% from September.

- Amidst recent news surrounding the metaverse, the floor market cap for virtual worlds is now estimated at $1 billion, growing 175% MoM; meanwhile, the dominance of virtual worlds NFTs went from representing 3% of the total NFT estimated market cap in September, to 8% estimated at the end of October.

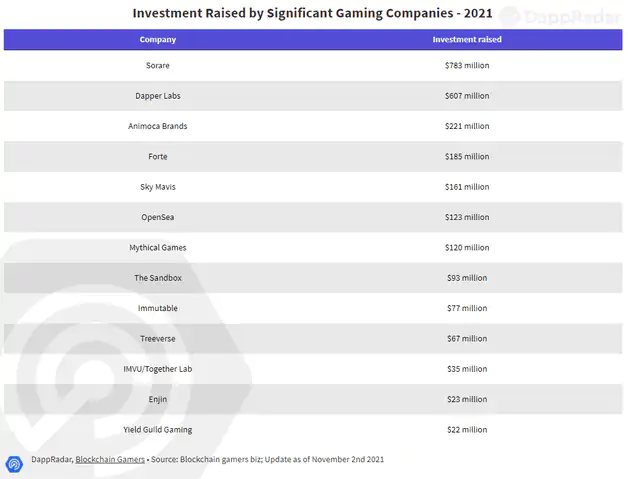

- In October VCs invested at least $127 million in blockchain games-related platforms that include Animoca Brands, Treeverse, and trading card game Parallel.

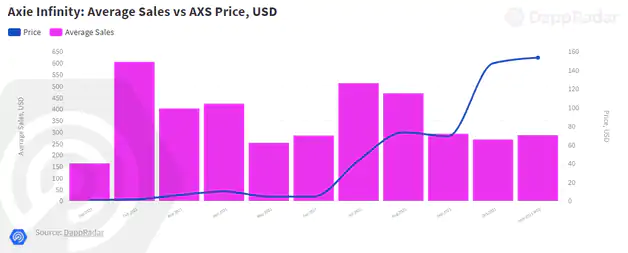

- Boosted by the AXS staking feature, Axie Infinity’s on-chain activity increased significantly, recording over 647,000 UAW in October, a 27% increase MoM. At the time of writing, $2.89 billion worth of AXS – or around 30% of the AXS total circulating supply, is staked into the Axie Infinity AXS Staking contract.

- Splinterlands continue to be among the most played games in the industry, attracting over 650,000 UAW in October, representing 44% growth MoM.

- The number of UAW connected to Polygon games reached 125,000 daily UAW on average in October; that number represents an impressive 242% MoM and a staggering 982% when compared to August.

Table of Contents

- Metaverse news boost virtual world platforms

- Axie Infinity on-chain activity grew 27% boosted by the AXS staking feature

- VCs lured by blockchain games invest at least $127 million in October

- Splinterlands player base rose 44% from September

- Blockchain games supporting Polygon’s outlook

- The state of GameFi on BSC

- Summary

Metaverse news boost virtual world platforms

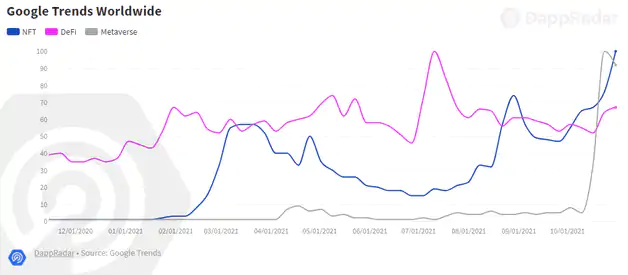

Since Mark Zuckerberg’s announcement that Facebook would rebrand to Meta Platforms, Inc, a direct allusion to the concept popularized by Ernest Cline in his novel Ready Player One, the metaverse has been a trending topic.

Blockchain-based virtual world games are tightly related to the abstract concept of the metaverse. A space that aims to become the digital universe where individuals will socialize and monetize their virtual experiences. When talking about virtual worlds, Decentraland and The Sandbox come to mind.

Since the announcement, cryptocurrencies, and essentially any type of asset that is related to virtual worlds, have been on the rise. SAND, The Sandbox’s utility, and governance token is trading for $2.5 at the time of writing, a price increase of 274% since October 1st. Not only has SAND’s price appreciated, but the land plots, NFTs that represent parcels of virtual land within this dapp, have also appreciated. The floor price of lands in The Sandbox, rose from 0.6 ETH in September, to almost 1.8 ETH at the end of October.

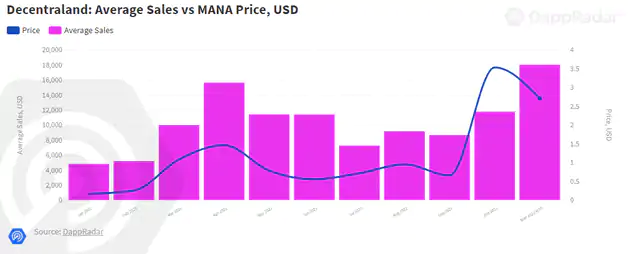

Decentraland, another dapp that is making its name in the blockchain-based virtual worlds, experienced a similar phenomenon. The price of MANA, Decentraland’s native and governance token, tripled since October 1st, reaching $4 on Halloween. The floor price for lands in Decentraland also benefited from this market effect, growing 204% MoM.

It is worth mentioning that Decentraland has been live for one year whereas The Sandbox is about to open up its gameplay to a wider audience. For now, the rise in valuation of their respective tokens should be considered purely speculative, until we see increased activity in these platforms.

Whilst The Sandbox and Decentraland pave the way for a decentralized metaverse, there are other projects in the space that while still under construction are poised to play prominent roles going forward. Projects like CryptoVoxels, Treeverse, Ember Sword, Somnium Space among several others, reacted favorably to the metaverse news. In all, virtual world dapps generated over $21.8 million in trading volume in October, up 31% on September numbers.

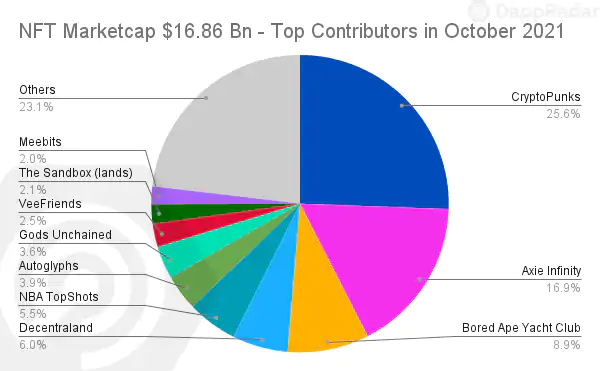

Also worth noting is the fact that the metaverse impact transcended the NFT space. In numbers, the NFT market cap for the top 100 Ethereum collections, plus NBA Top Shot, was estimated at $16.8 billion at the end of October. That number has increased by 18% MoM.

Despite a decrease in the price of some of the most important collections that saw CryptoPunks floor fall by 20%, BAYC by 10%, and Kongz and Cool Cats by 6%, the NFT market cap surpassed September’s records. Obviously, the surge in the price of ETH played an important role, but the assets belonging to virtual worlds left their mark as well.

The floor market cap for virtual world NFTs grew 175% MoM and the NFT floor market cap figure for virtual worlds is estimated at $0.98 billion. Furthermore, virtual worlds went from representing 3% of the total NFT estimated market cap in September, to an estimated 8% at the end of October. The dominance of virtual worlds NFTs is growing by the day. It appears that the sky’s the limit, as the biggest names in the space are still about to release their current developments, while others like Axie Infinity are yet to integrate virtual worlds into their game mechanics. It’s about as bullish as it can get.

Axie Infinity on-chain activity grew 27% boosted by the AXS staking feature

While the virtual world of Lunacia is still under development, Axie Infinity achieved important milestones in its successful journey. At the end of September, the SkyMavis team introduced the AXS staking feature. This move strengthens the Axie ecosystem by adding another passive income layer.

At the time of writing, $2.89 billion worth of AXS is staked in the Axie Infinity AXS Staking contract, representing almost 30% of the AXS total circulating supply. The AXS staking feature propelled the play-to-earn (play-to-earn) game’s on-chain activity. In October, over 635,000 UAW connected to Axie Infinity, making it one of the top 3 games in terms of on-chain activity.

The impact of Axie Infinity in the NFT space is well documented too. As observed in the NFT market cap chart above, Axie NFTs represent 17% of the NFT market cap. In October alone, Axie NFTs generated almost $485 million in volume.

Axie Infinity’s story has been one for the ages. The play-to-earn game already has over 2 million daily active users and has announced revamps to its game mechanics. Virtual land and an enhanced battle mode are on the horizon. With the $152 million Series B funding led by a16z at a valuation near $3 billion, the future is more than bright for the pokemon-inspired dapp.

VCs lured by blockchain games invest at least $127 million in October

The latest explosion in both NFTs and games has not only lured the attention of mainstream media but also hefty investors or Venture Capitalists (VCs) have set their sights on the space. Furthermore, VCs have been particularly interested in the blockchain game sector, where important investments and fundings have made big headlines.

Animoca Brands, a Hong-Kong based VC organization that focuses on digital entertainment, gamification, and blockchain continues to be the primary group funding blockchain-based projects. However, in early October, gaming giant Ubisoft announced a $65 million investment in Animoca Brands showing that more mainstream gaming companies want to gain exposure to blockchain gaming. The funding news raised Animoca’s valuation to over $2.2 billion.

Only last month Animoca Brands invested an undisclosed amount in Star Atlas, the upcoming play-to-earn open-world space exploration MMORPG. This month, Animoca Brands invested an undisclosed amount in the MMORPG Treeverse. This investment expands the firm’s portfolio that already includes important dapps like The Sandbox, Revv Racing, and Arc8, along with several other traditional game platforms. In addition, Lympo, a subsidiary of Animoca Brands, recently announced a collaboration with Polygon Studios in an effort to consolidate a strong play-to-earn offering in the Polygon network.

SoftBank’s Vision Fund 2, a subsidiary of Japanese giant Softbank, is another example of important VCs getting involved within the industry. In September, Sorare, the French startup behind the play-to-earn fantasy football (soccer) game, secured a ??$680M Series B round from Softbank’s VC. Adding to its portfolio, SoftBank’s Vision Fund 2 announced a $93 million investment in The Sandbox last week, yet another domino to fall in the recent metaverse craze.

All in all, these types of investments will not only play an important role in supporting the current development of Web3 projects, but they also act as a vote of confidence for future digital economies. October saw intriguing investments like the $50 million funding raised by trading card game Parallel, or the Treeverse’s undisclosed funding led by Animoca Brands.

Play-to-earn dapps are expanding across the whole globe, while projects like The Sandbox keep building the virtual space where individuals will socialize, trade, and even earn.

Splinterlands player base rose 44% from September

The usage of blockchain-based games has been steady since the boom experienced during Q2. One of the main actors behind the trend has been Splinterlands. Splinterlands is a play-to-earn trading card game that runs on the Hive blockchain. After analyzing October numbers, they seem impressive.

Splinterlands has been featured in recent DappRadar game reports. For example, in our latest quarterly review, we noted that Splinterlands had grown its user base by more than 3,200% in just three months. That notorious growth did not stop in October whatsoever. Actually, in the last month, Splinterlands was consistently among the top 2 most played games based on on-chain activity, attracting over 650,000 UAW in the last month. Even after the tremendous user increase seen in Q3, Splinterlands UAW grew 44% MoM.

Amidst growing demand for the game, Splinterlands released the Chaos Legion expansion. This new deck of cards not only increases the card supply, but it will also change the strategy of the play-to-earn mechanics. The Chaos Legion cards will earn Dark Energy Crystal (the game’s main currency) tokens at a different ratio from the Genesis cards. In addition, it is expected that virtual land becomes part of the game at some point in the near future. Overall, Splinterlands has established itself as a play-to-earn powerhouse.

Blockchain games supporting Polygon’s outlook

The narrative in the Polygon network is rapidly evolving. Just a couple of months ago, Polygon was clearly established as a DeFi blockchain hosting several of the leading DeFi dapps as part of the multichain paradigm. Two months later, the chain was surpassed by Solana, Terra, Avalanche, and even Fantom in terms of TVL. But that’s another story. What is relevant for the scope of this report is that the interest in games hosted within Polygon is growing.

The number of UAW connected to Polygon games reached 125,000 daily UAW on average in October. That number represents an impressive 242% MoM, and a staggering 982% when compared to August. Whereas the number of DeFi associated transactions decreased 52% MoM, the game transactions doubled compared to September.

The main driver behind this surge is Arc8, a mobile play-to-earn game launched by Gamee, a subsidiary of Animoca Brands. The launch of Arc8 came along with a liquidity program to mine GMEE, Arc8’s governance token. Boosted by the program, the game managed to attract over 373,000 UAW in October. That’s easily the highest among Polygon-listed dapps.

While the success of Arc8 may be attributed to the aforementioned liquidity program, it is undeniable that Arc8 tackles an unexplored space for blockchain games, the mobile game sector. The liquidity program ended in October, coinciding with the massive drop in usage. Nonetheless, Arc8’s complete list of mini-games was fully deployed since, so it’s worth watching whether Arc8 consolidates itself as a strong option in a less crowded mobile play-to-earn sector.

Arc8 shows that with the right product, Polygon may become a platform for games and entertainment. Besides the mobile play-to-earn dapp, Polygon is already home to interesting game options like the GameFi dapp Aavegotchi, and the racing game Revv Racing. Elsewhere, The Sandbox and the trading card game Doctor Who: Worlds Apart, have announced their integrations into the Polygon ecosystem. We’ll continue to closely monitor the state of the game in Polygon.

The state of GameFi on BSC

BSC’s game offering has become a centerpiece of the Binance-branded network. What started as a blockchain-focused on DeFi, BSC has now become a real house of GameFi dapps. While the UAW connected to BSC games (around 20%) are still far from the industry benchmark of 55%, the interest in GameFi dapps hosted on BSC is still positive. As an example, the number of transactions related to BSC-based games doubled in October when compared to the previous month.

The game sector on BSC has been a tale of two stories. On one hand, two GameFi BSC dapps have maintained their positions as top 10 games played in October. Mobox: NFT Farmer, a GameFi dapp that combines DeFi features with playable NFTs attracted over 157,000 UAW in the last month. Despite a 26% decrease in usage MoM, the TVL grew by $10 million, reaching more than $325 million in assets locked within the game.

CryptoBlades is another BSC GameFi dapp that has been regularly featured in our reports. CryptoBlades enjoyed an impressive run during Q3 that saw the game become the most played game (based on on-chain activity) at one point in August. This was mostly driven by the surge in the price of SKILL, the game’s native currency.

Nonetheless, interest in the game spiked tremendously, falling from more than 650,000 UAW in August to over 90,000 in October as the price of SKILL collapsed. Still, the game remains a top 10 game based on playing activity, and the CryptoBlades team is preparing interesting enhancements to game mechanics. This includes the launch of CryptoBlades Kingdoms, the game’s sequel that will introduce strategy-based digital land building and will feature guilds, PvP battles, and PvE events like 1-on-1 environment battles, raids, and dungeons.

In contrast, it appears that outside of the two aforementioned GameFi dapps, no other BSC game has kept relevance for an extended period of time. In previous months we saw the likes of My DeFi Pet, X World Games, CryptoZoon, and CryptoBay attract more than 100,000 unique wallets respectively, which shone a spotlight on the whole play-to-earn community. Nevertheless, the hype surrounding these games was quite fickle.

By the end of October, CryptoMines, another GameFi mining-related game, cracked DappRadar rankings as one of the most played games in October. With over 120,000 UAW in October, can CryptoMines alter the trend and join CryptoBlades and Mobox as true BSC representatives.

In summary

After a very solid Q3, blockchain games continue their strong run in October. Propelled by the narrative around the metaverse, VCs and blockchain enthusiasts are also making headlines in this exciting category.

Firstly, virtual world games like The Sandbox and Decentraland saw their value appreciate dramatically. Their respective native currencies tripled since Facebook’s rebranding announcement, while the price of land was also on the rise. As previously mentioned, these trends remain highly speculative for now, yet it is worth monitoring upcoming land sales, as they have proved to become valuable investments.

Another game that will also feature digital lands is Axie Infinity. But besides the highly expected land feature of Lunacia, the Axie ecosystem was strengthened once more with the release of Katana, Ronin’s decentralized exchange platform. A liquidity mining program was launched simultaneously to farm RON, the upcoming Ronin governance token. It will be interesting to see how Katana affects Ronin’s metrics in November.

Furthermore, games continue to drive usage in the blockchain industry. Based on the UAW analysis, game dapps continue to be the most used category of the entire industry. While incumbent game blockchains like Wax and EOS saw their audience shrink, strides made in other networks accompany an optimistic narrative that explains the most recent surge.

The latest example is Polygon, a blockchain highly associated with DeFi, which now offers a good variety of play-to-earn games that include mobile dapp Arc8. With interesting games in line to use Polygon as their core infrastructure, Polygon’s future will not be DeFi dependent anymore.

The case of Wax is one to monitor closely, as the Alien Worlds missions were recently launched on BSC. In addition, Farmers World is scaling its trading volumes on Atomic Marketplace, and the recently launched Coin Pirates is expected to attract an audience.

Overall, the state of the blockchain game industry is as bright as ever. The metaverse is being constructed as you read, and interest in the space has never been higher. While the report covered the main events that occurred in October, be sure to check out the rankings page for a closer look at your favorite game dapps.