ApeBond and QuickSwap have introduced the QuickSwap Bond Program to the Polygon ecosystem to bolster liquidity and present new and innovative incentives for liquidity providers. These bonds allow investors to purchase tokens at a discount, and claim them after a vesting period.

ApeBond, formerly known as ApeSwap, is one of the DeFi powerhouses known for their efforts on BNB Chain. They introduced bonds last year, and are now bringing their product to different chains. By collaborating with QuickSwap, bonds make their debut on the leading DeFi platform on Polygon.

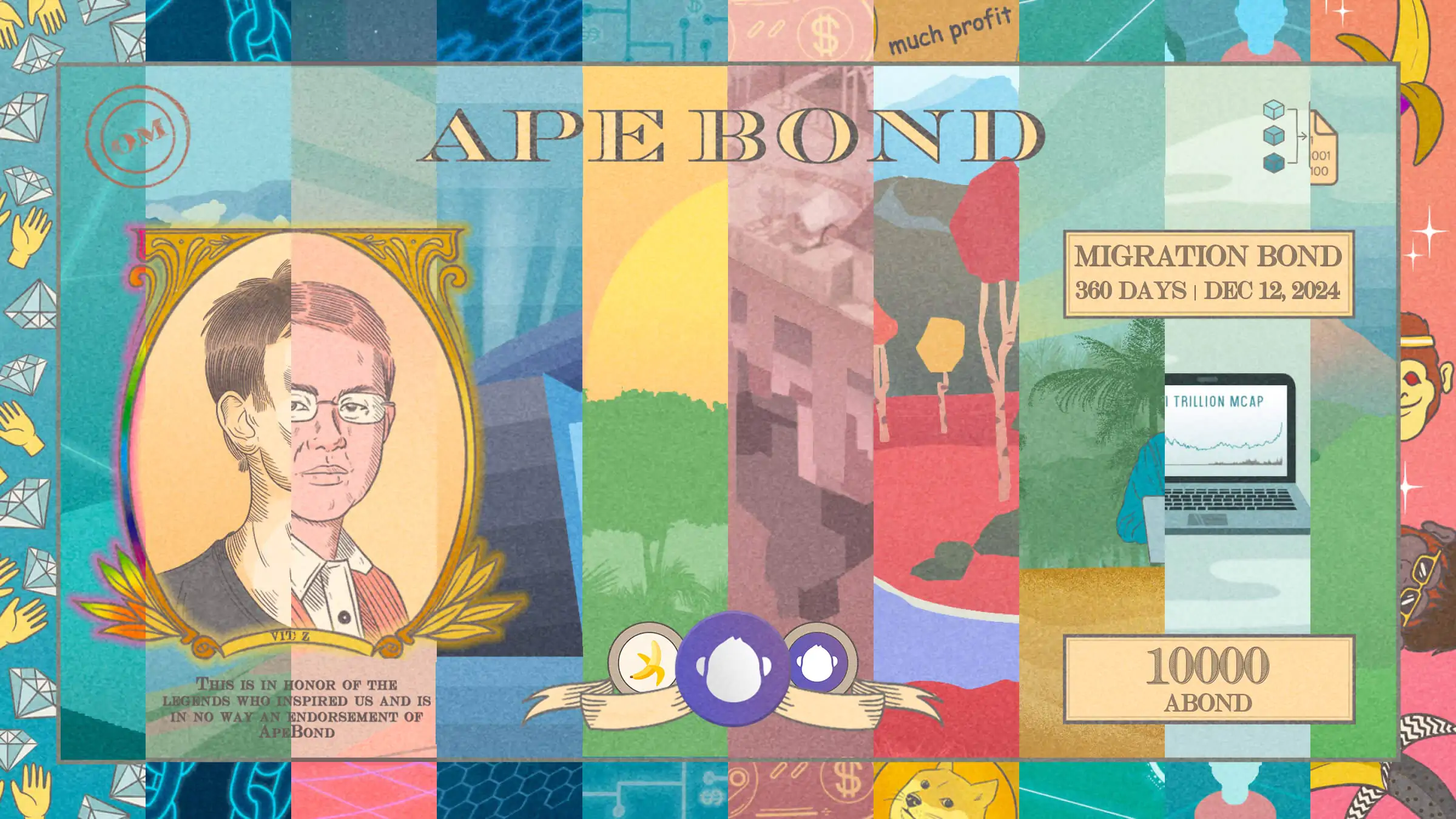

By introducing bonds with the number one decentralized exchange on Polygon, QuickSwap is well positioned to attract more investors looking for innovation. The QuickSwap Bond Program allows users to exchange their liquidity provision tokens (LP tokens) for discount bonds, presented as nicely designed NFTs.

Why bonds are better than yield farming?

Protocol-owned liquidity and bonding is a much better method to generate liquidity than yield farming because it benefits both the protocol and the community. In yield farming users provide liquidity in a pool, and then stake their LP tokens to receive a yield. Once the reward pool dries up, the liquidity may disappear as well as users pull out and move to a new yield farm.

This is bad for the community. That’s why bonding is so good. Instead of staking, liquidity providers sell their liquidity in exchange for a NFT bond. And after a certain vesting period they can claim the value of the bond, plus some bonus reward tokens.

On the other end of the spectrum, the liquidity is now owned by the protocol. The more organizations purchase LP tokens from liquidity providers, the smaller the risk that big amounts of liquidity get removed from the liquidity pool. As a result, trading conditions remain positive without too much slippage and enough liquidity to facilitate big trades. Ultimately bonding is a solution with a long-term vision.

How does the QuickSwap Bond Program work?

- Go to the QuickSwap website

- Connect your wallet, and make sure it’s set to Polygon

- In the menu Earn > Bonds

- Scroll down to see the available bonds

- Provide the liquidity (single tokens or LP tokens)

- And you will receive an NFT bond

- After the vesting period you can claim the full amount of your token rewards

Closing words

Where liquidity providers and protocols only have short-term benefits when dealing with yield farming, bonding provides long-term benefits. QuickSwap understands this, and continues to evolve by implementing new and innovative incentives to drive liquidity. With a horrendously turbulent 2023 for the web3 market finally coming to a close, QuickSwap and ApeBond are looking ahead. The crypto market seems to be in the early stages of a bull market, and DeFi will reign again once new liquidity flows into the Web3 ecosystem.