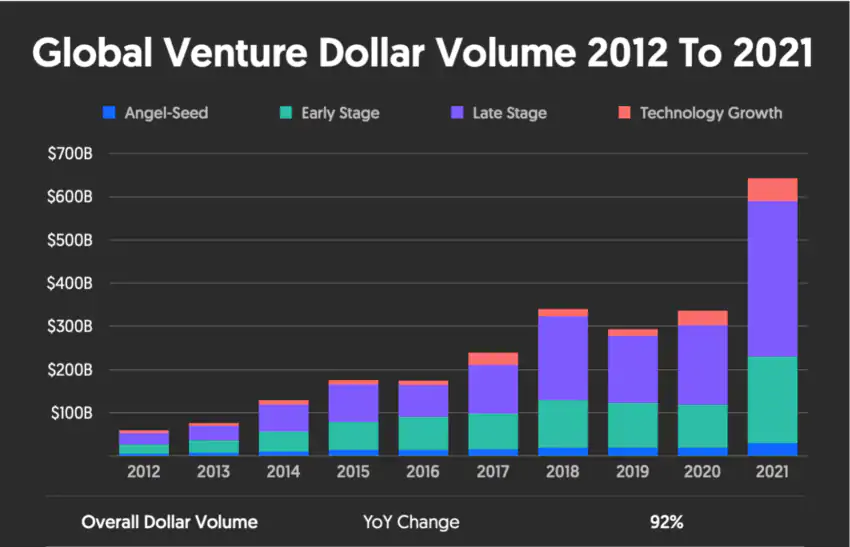

2021 saw venture capital activity amounting to $612B, a 108% increase from the year prior and a 24% increase in VC deals. But despite the pros, there are some painful pain points attached. DAOs can be a good vehicle for addressing some of the gaps in the traditional VC landscape. Enters a

Venture capital funded more than half of all US public companies in 1979. Thus, representing a third of all stock market’s value. All the top 5 most valuable companies in the US (Apple, Microsoft, Google, Amazon & Facebook) began as VC-backed startups.

Venture funds specialize in funding start-ups that have yet to turn a profit but have high growth potential. Sometimes even returning more than 100x of the initial investment. VCs fund start-ups out of equity rather than debt because startups are cash poor but can have enormous upside potential.

The traditional VC space has obvious pros like big check sizes, resourcefulness, and doubling down investments and networks. But there are some painful pain points, such as slow decision-making, high bureaucracy, high valuation sensitivity, and high demand for control, to name a few.

Decentralized Autonomous Organizations () are a good vehicle for addressing some of the gaps in the traditional VC landscape. A decentralized version of a company, DAO is driven by community governance and decision-making, directly targeting some of the conventional VC pain points. Thereby enabling faster decision-making, lesser control for start-ups, and adhocracy. Additionally, DAOs provide increased investor flexibility, increased diversity of funded ideas, de-centralized control, and improved access to public capital.

That said, does the future of VCs looks safe with the reincarnation of DAOs and their implications?

Therefore, this article explores the overarching question: “Will DAOs potentially replace VCs, or do DAOs pose a threat to VCs?”

The traditional way: VCs

Among the three ways to invest in private capital – are buyouts, growth funds, and venture capital.

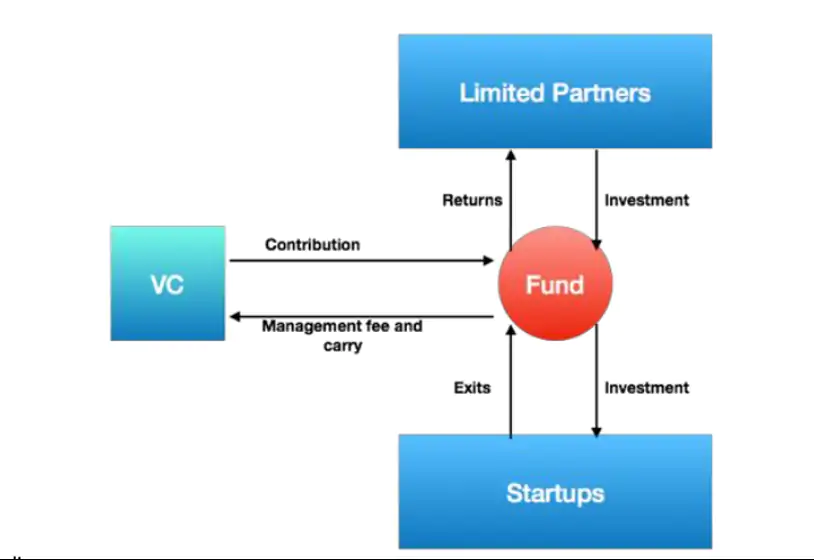

Venture capital is a form of private equity that finances start-up companies that are expected to have an exponential return and high-growth potential. In technical explanations, venture capital firms create a fund of blind pool investments, not knowing what companies they would invest in. But making an investment mandate on what types of start-ups they would invest in.

Here’s a basic flowchart to showcase how Venture Capital works, reiterating Medium’s 2018 blog.

The annual return for a VC fund from 15-27% and has a high premium compared to S&P 500’s 9.90% return in the last ten years. With the increasing growth, especially in Asia, there has been an increase in the number of deals and funding poured into start-ups worldwide.

In 2021 reached $612 billion in venture capital activity, which was a 108% increase from the year before. In 10 years, the growth of dollar volume invested in ventures around the globe is 92% YoY.

In 2021, there was also a 24% increase in the number of VC deals around the globe, with numbers as big as 11,601 deals. Despite the apparent rise, there are specific pain points. Such as the founder’s reduced stake, the delay in decisions and funding timelines, and much more.

DAO VCs: The concept

DAO VC is building on the concept of community decision-making and governance, in contrast with traditional VC central authority decision-making. It will be an autonomous venture ecosystem for both end users and start-ups.

DAO VCs present themselves as an exciting platform allowing retail investors to transition into the crypto space. While allowing start-ups to have a diverse pool of investors. By investing as low as $1, users can participate in the market like more prominent traditional investors. Simply by creating a shared collection of contributors acting as token holders.

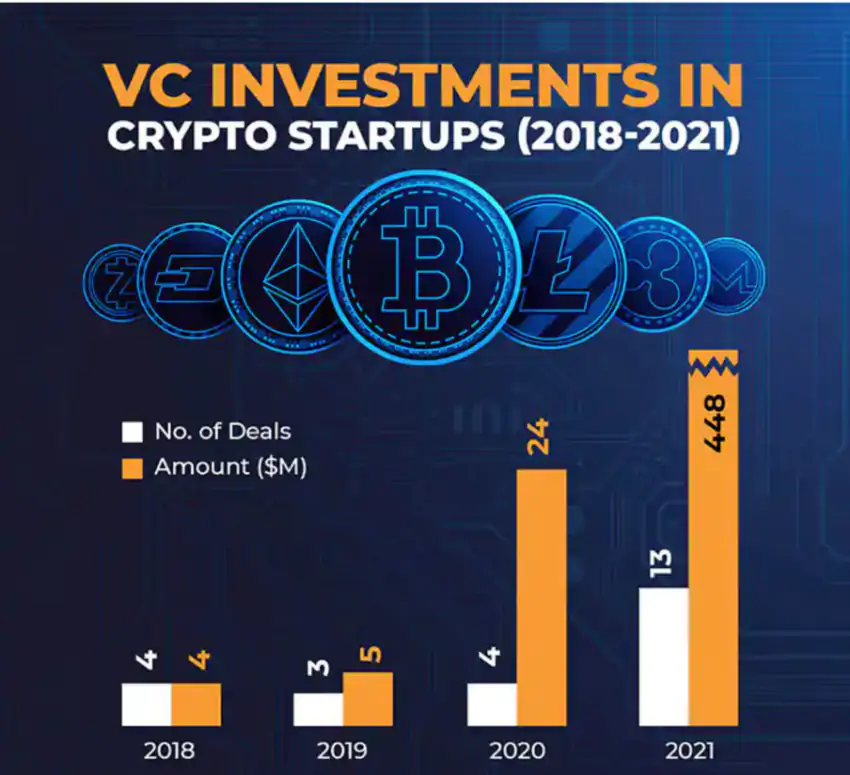

The rise of blockchain technology has changed the way investors could think about venture capital funds. VCs are increasingly diversifying their funds into the cryptocurrency space. Even are thinking about how to fundamentally change their fund structure so that it is centralized and allows for a more inclusive environment for many investors to play in the space.

Bridging the gap

The use of DAOs and adopting hybrid financing models to imitate “initial coin offerings (ICOs)” are two ways the VC is starting to innovate in space to bring more funding and participants into space.

A DAO can be described as a “community formed around a central idea that each member thinks is worth investing in. Money pooled within that DAO keeps track of each person’s contribution and gives proportionate governance rights”.

And though DAOs are a relatively new concept, their rapid suggests a future trend that can have significant implications for the Venture Capital landscape. Less than two years ago, when Ethereum was trading at $230, DAOs were few and far between. Most of them only held a few thousand dollars of AUM.

However, “after a year-long crypto bull market, millions of new people introduced to crypto, and thousands of projects launched and generating fees,” DAOs are now measuring in the millions.

The total assets under management (AUM) for DAO treasuries, listed on the DAO stats platform DeepDAO increased from around $380 million in Jan. to a peak of roughly $16 billion in mid-Sep. in 2021.

“2021: The (1st) year of DAO”??

Here is how the DAO ecosystem grew in last 12 months??:

DAOs’ treasuries listed on @DeepDAO_io went up 40x, from $400M in January to $16B by December 2021

Participants in DAOs went up 130x, from 13k in January to 1.6 Million by December 2021 pic.twitter.com/YFcblpBOK8

— DeepDAO.io (@DeepDAO_io) December 30, 2021

DAOs rise from 2021 to 2022

BeInCrypto reached out to Rona Perry, the COO of DeepDAO, to comment on the current scenario compared to the last year via email. She responded with a comment saying:

“While the bear market continues, the pace of growth in new DAOs is accelerating. The total number of new DAOs created this year is larger than last year, and each month this year has seen 2x+ new DAOs than in 2021. The numbers reflect the ongoing interest in Decentralized Autonomous Organizations, and their unique place as a key infrastructure of Web3.”

During the six months from May to October this year, 2863 DAOs started their governance activity. This is more than twice the number from 2021, as seen in the graph below.

Further shared a Nov. 24, 2022 tweet that shed more light on the growth year by year from 2018 to 2022.

3/ For the purpose of counting a DAO as new, we looked at the date in which they created their first proposal.

First proposal seems to be the most indicative measure of when a group becomes a DAO, although a more granular approach is needed, and coming soon from our R&D.

— DeepDAO.io (@DeepDAO_io) November 24, 2022

DeepDAO ranks Uniswap DAO, BitDAO, and DAO as the top three, with treasury value at $2.30 billion, $1.70 billion, and $1 billion. Overall, the DAO has 10,191 members and focuses on proposals relating to direct partnerships or swaps with projects. Also, expansion opportunities such as the launching of autonomous artist guilds, farming cooperatives, and ecosystem funds.

Indeed, the rise in demand is an obvious one. But what pros and cons might one consider or know about DAOs?

Points to consider

Decentralized Autonomous Organizations (DAOs) are a good vehicle for addressing some of the gaps in the traditional VC landscape. Some advantages include expanding access to VC investments, increased investor flexibility, increased diversity of funded ideas, de-centralizing control, and better access to public authority.

While DAOs represent great opportunities across multiple stakeholders, the inherent risks of the blockchain industry cannot be ignored. As with any new technology, DAOs have certain risks, such as security threats and arbitrary decision-making. When transitioning from the traditional VC to the DAO VC space, these risks must be treated carefully.

Some apparent disadvantages include a lack of resources, regulatory policies, security, and ownership.

Expanding on two key concerns: regulations and security

Stricter Regulatory Policies: Regulatory scrutiny likely to intensify as DAOs increase in number

Given the growth in the number of DAOs, they can no longer operate under the radar and dodge regulatory measures. Thereby making it increasingly more difficult to set- up and use a DAO. With the growing investment sizes or funding amounts flowing through DAOs, regulators may start cracking down on even these limited membership DAOs.

Since DAOs provide some level of anonymity, they could serve as another vehicle to launder money from illegal operations, which gives the SEC another reason to investigate.

Furthermore, since tokens can be bought and sold through blockchain technology, regulators consider these tokens as securities. Regulators could introduce new policies that enforce stricter measures around capital gains from token trading. Thus, as the landscape for DAOs continues to evolve, new policies around this space can be expected to emerge.

Security: Flaws in a DAO’s code/Smart Contract could put the assets at risk

As covered by BeInCrypto in the past, different explicit activities were carried out to hack DAOs. For instance, just a month ago, OlympusDAO suffered a $300k exploit. In 2016, an attacker was able to siphon out a total of 3.6M Ether out of the DAO, which was worth $55 million, about a third of the total assets. The attack was made possible due to a glitch in the underlying code of the DAO, which caused the DAO to process the same transaction several times.

Code by code

A DAO’s underlying code, also known as Smart Contract, acts as the rulebook that sets up its self-executing nature, abolishing the need for human intervention that the Ethereum-based investment fund is famous for. The glitch caused the DAO to process the same transaction several times.

The DAO is reliant on a flawless Smart Contract. Should there be a bug or a mistake in the underlying code of the DAO, it leaves the assets of the investment fund at risk. This is a risk that does not exist with the incumbent traditional venture capital fund. The security of the asset in a traditional VC firm is not at risk of being stolen by an anonymous attacker.

Zooming out, risks and pitfalls are associated with the new and upcoming DAOs trend.

Closing thought

With the growth in Web 3.0 initiatives and projects in the metaverse, the emergence of DAOs will continue to rise. VCs who would like to participate in the Web 3.0 space opportunities are now challenged to stay competitive and relevant in light of these DAOs.

Despite the democratization brought about by DAOs, investors need to remain wary of the risks of DAOs. Mainly regarding investment strategies and security. VCs may continue to have the edge over DAOs regarding their network of contacts built over the years and their expertise in scaling businesses with start-up founders.

To get the best of both worlds, investors should keep an eye out for a DAO-VC hybrid model. That is leveraging the community-driven ethos of DAOs and VCs’ operational expertise. This new hybrid setup will continue to challenge the boundaries of the traditional VC setup. Further, look into new ways to make this an effective model.

With the emergence of DAOs and the hybrid model, start-up founders become the winners with more funding options and a comprehensive set of investors to choose from who will best align with their vision.

Got something to say? Write to us or join the discussion on our Telegram channel. You can also catch us on FacebookTwitter