Bitcoin is now down 75% from its previous all-time high of $62,000 – set in November 2021.

The crypto market is suffering from a plethora of reasons – inside and outside of the industry.

Like most things that unravel, crypto started to unwind gradually at the start of the year and then pretty much collapsed all at once.

From global economic instability to European wars to localized crypto empire collapses – here are five reasons why Bitcoin is on the path to $10k

Why is Crypto Crashing?

This is a prevalent question in the industry:

“Why is crypto Crashing?”

Analysts have a plethora of reasons to highlight.

The price of Bitcoin reached an all-time high price of $62,000 in November 2021. Since then, the price has tanked by a total of 75% to the current $16,500 range.

Like every market, Bitcoin moves in cycles of bull runs and bear busts. The past two years leading up to November 2021 were undoubtedly the most extensive bull run for crypto. Unfortunately, we are currently trading inside one of the biggest bear busts in history for Bitcoin.

You only need to look at the weekly chart for the coin to see the impact;

With that being said, here are five of the most popular reasons why crypto is currently crashing and why it’s likely to end up beneath $10,000 before it starts to recover.

1 – Global Macroeconomics – Inflation and War

One of the primary drivers behind the crypto crash is related to broader macroeconomics, particularly inflation and war.

The fallout from the COVID-19 pandemic caused central banks worldwide to start printing money to stimulate the economy.

As a result of the additional stimulus measures, inflation started to creep higher over the past two years. According to the U.S. Bureau of Labor Statistics, Inflation has been rising since 2021 and peaked above 9% earlier this year.

In fact, the inflation rate reached a 40-year high during this time period;

With inflation rising, the cost of living significantly increases. As a result, prices go up, and everything including housing, utility, shopping, and entertainment sees a significant cost rise.

In this type of situation, central banks must implement tight monetary policy to keep prices in check and stop the economy from growing too quickly. Typically, they use increasing interest rates to combat rising inflation.

Increasing interest rates causes borrowing money to become more expensive. This leads to less spending in the economy and more savings. In addition, there is less liquidity available in capital markets as the cost of borrowing is much more expensive.

With reduced spending, inflation tends to head lower, but it takes some time.

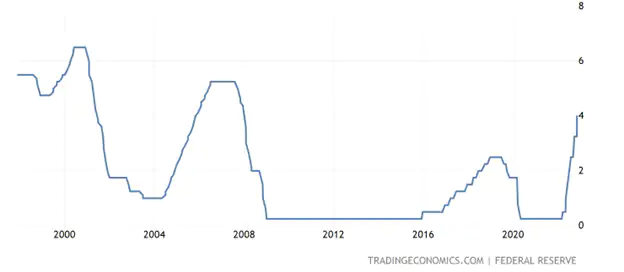

The US Federal Reserve has been hiking interest rates since March 2022. In fact, they have increased interest rates at the most aggressive rate since the 1980s in an effort to curb inflation.

The US Fed started slowly increasing rates in March by hiking the rate by 25 basis points (BPS). Then, in the following meeting in May, they hiked by a further 50 BPS. In June, the most significant hike came in at 75 BPS, causing the market to accelerate downward.

Since June, the Fed hiked by 75 BPS in July, September, and November. As a result, the current interest rate in the United States is now sitting at 4%, and rates are still expected to go much higher.

Many experts assume that the market won’t even start to recover until the US Fed stops hiking interest rates.

It’s not just inflation that’s causing global economic pressure. Russia has been waging war on Ukraine since February this year, and it doesn’t seem to end anytime soon. With war occurring on European soil, investors are erring on the side of caution until the uncertainty has vanished.

2 – Luna Collapse

Amidst the first wave of interest rate hikes, one of crypto’s top-20 ranked projects came crashing down, propelling the bearish downward pressure in the industry. This was the first strong indicator that Bitcoin was heading toward $10,000.

It was during the Terra Luna collapse when analysts started to hint at potential $10,000 prices for BTC;

CryptoWhale: LUNA makes up around 0.98% of Bitcoin's volume, whereas USDT makes up over 79.2%.

The de-pegging and collapse of Tether will impact the markets a hundred times worse than Luna, and tank us far below my $10,000 targets.

Good Luck Everyone – Stay safe!

— Faisals Crypto News (@faisalscrypto) May 12, 2022

On May 7th, 2022, the price of the TerraUSD (UST) stablecoin lost its $1 peg and sent the market into a frenzy. The price for UST fell to just 35 cents by May 9th and continued to plummet the following week. In addition, the companion token used to stabilize UST, LUNA, fell from $80 to under ten cents by May 12th.

As you can imagine, the crypto market started to tank. Bitcoin fell from above $40,000 to hit as low as $26,000:

As a result of the Luna collapse, the market lost an estimated $60 billion in the space of a few days.

This was the first major breakdown of the strong support structure for 2022, and it only worsened from there.

The meltdown affected the entire market during a time of increased volatility resulting from the global macroeconomic crisis, resulting in a liquidity squeeze in the industry. In addition, prominent cryptocurrency hedge funds such as Three Arrows Capital also were wiped out during the fallout.

3. FTX Collapse

The Luna collapse wasn’t the only localized crypto meltdown in 2022. More recently, in November 2022, one of the biggest cryptocurrency exchanges in the industry was utterly wiped out. On November 11th, 2022, FTX.US filed for Chapter 11 bankruptcy, and to make matters worse, the exchange suffered a hack that saw $600 million being drained from its wallets.

The exchange crashed due to a lack of liquidity and mismanaged funds. Changpeng Zhao (CZ), owner of BINANCE exchange, Tweeted Binance was about to sell all of their FTT funds due to the CoinDesk report of FTX’s liquidity crisis.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ ?? Binance (@cz_binance) November 6, 2022

This Tweet was the final nail in the coffin for FTX. It sent panic to all FTX users, who quickly rushed to the exchange to withdraw funds. As a result, the liquidity crisis at FTX worsened, eventually leading to bankruptcy.

The result of the FTX collapse was another 25% price drop in BTC as it fell from $21,300 to reach as low as $15,500.

This price drop was quite significant as it caused BTC to break through the 200-weekly moving average level, which brings us to the following reason…

4. Losing Critical Support at 200-weekly Moving Average

The 200-weekly moving average level has been a technical support point for most analysts in the industry.

In its history, Bitcoin met the 200-weekly average price on four separate occasions and rebounded from the level on each occasion.

However, the FTX collapse sent the market beneath the critical support level for the first time.

#Bitcoin and 200 weeks moving average

During its short life span, #bitcoin has found support at 200 WMA on 4 occasions and rallied from there.

But not this time. It's been 15 weeks since the break of 200 WMA.

Ominous. pic.twitter.com/XOfMeqFF5N

— Mayank Narula (@Mayank_Narula1) November 22, 2022

The level was critical support for analysts across the industry and was the only significant barrier before $10,000. The loss of the 200-weekly moving average now means that the next level of crucial support lies at $10,000.

5. Loss of Sentiment

Finally, the loss of sentiment is the final vital reason to mention why Bitcoin is heading to $10,000 before any hope of recovery.

The sentiment of an asset is what drives markets. So if investors are optimistic about the future price of Bitcoin, then the sentiment is high and they will keep buying.

On the other side, if investors aren’t optimistic about the future price of Bitcoin, then sentiment will be low and they have no reason to keep buying.

The crypto fear and greed index is a great metric to analyze sentiment. It’s currently at one of the lowest levels in history, indicating that there is extreme fear in the market;

As a result of the extreme fear, the market will likely continue the downward pressure until hitting the next major psychological level – which is at $10,000.

Cryptos to Hedge With as Bitcoin Sinks

Despite the bearish pressure in the market, there are still many segments in the industry that are still experiencing growth. These projects have very promising futures, and, as a result, investors are quickly flocking to them as a hedge against the Bitcoin breakdown toward $10,000.

Here are three promising projects to keep your eyes on over the coming months. Investing in these projects could help your portfolio stay green while the rest of the industry plummets.

Dash 2 Trade – Helping Traders Become Consistently Profitable

Dash 2 Trade is a world-class analytics and intelligence platform designed specifically for the cryptocurrency industry.

The platform aims to provide in-depth market insights for traders to make more informed decisions to help them become consistently profitable.

The dashboard will provide actionable crypto trading signals, market predictions, social analysis, and on-chain metrics to help traders keep track of the market.

The crypto market moves at a lightning-fast pace, which makes it highly challenging for traders to keep up with the latest developments.

The ability to give traders insights into the market will be one of the most significant factors of success for a trader. A trader with up-to-date knowledge can consistently make better decisions to succeed in the market.

How Will D2T Impact the Industry?

The impact of the Dash 2 Trade dashboard on the industry will be momentous. It will provide inexperienced traders with the knowledge they need to make better decisions and help advanced traders keep on top of on-chain data and create and test new strategies.

One of the flagship offerings of Dash 2 Trade will be its bespoke ICO and presale scoring system. This feature will help traders avoid potentially dangerous honeypots and daily scams.

The presale space is an excellent tool for providing insights about where the general market might be heading. Keeping track of this space would allow traders to make decisions earlier and increase their profits.

The bespoke presale scoring system will assess metrics such as team credentials, contract audits, and tokenomics. It will also analyze the sentiment data and social statistics for the presale and come up with a score on the likelihood of success for the project.

The team will also manually score projects to assess metrics that cannot be evaluated by automatic software.

Alongside the bespoke presale scoring system, the dashboard will provide additional features, including:

- Trading Signals with buy/sell opportunities

- Social sentiment and on-chain analysis

- Strategy builder

- New Crypto listings

- Trading competitions

Why are Investors Flocking to D2T?

The presale for the D2T token is currently underway and gaining significant traction. The project has almost raised $7 million – and it’s only been live for over a month:

Investors quickly rush to the presale after learning about the team behind the project. Dash 2 Trade is being created by the same team that delivered Learn 2 Trade – an FX signals and education platform that gathered a user base of over 70,000 people.

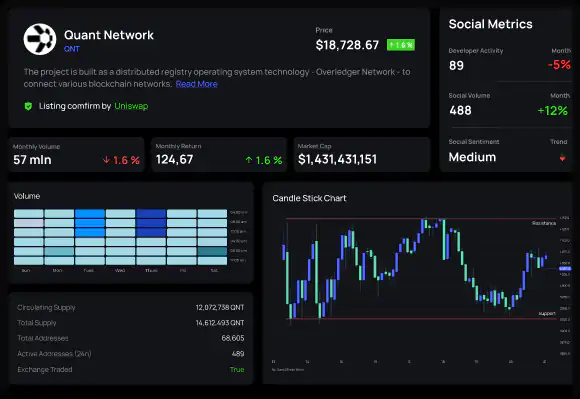

Quant developers and high-profile venture capitalist investors back the team. They have partnered with profitable crypto traders, quants, and AI developers to deliver the crypto-based dashboard.

D2T will be the utility token that will power the project. It will be needed to pay for the subscription to use the dashboard.

Buy Dash 2 Trade Today

IMPT – Pushing Crypto into a Greener Future

IMPT is an ecosystem designed to help push the world (and crypto) into a greener future.

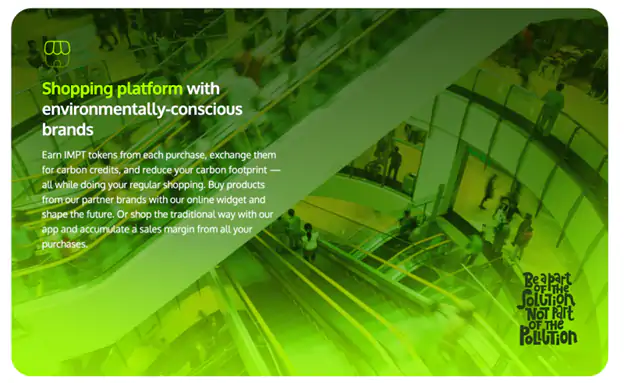

The platform allows individuals, businesses, and crypto projects to purchase carbon credits to reduce their carbon footprint.

A carbon credit is a permit representing one ton of carbon dioxide released from the atmosphere. Large-scale industrial corporations must purchase carbon credits to offset carbon emissions from production. However, it’s extremely difficult for small businesses and individuals to enter the market due to restricted pricing data and prevalent scams in the carbon credit market.

IMPT is seeking to change this as they believe everybody should have the opportunity to contribute positively to the environment – regardless if they are capable of buying carbon credits.

They will also have a shopping platform that will let shoppers earn carbon credits as cashback for regular online purchases.

How will IMPT Impact the Industry?

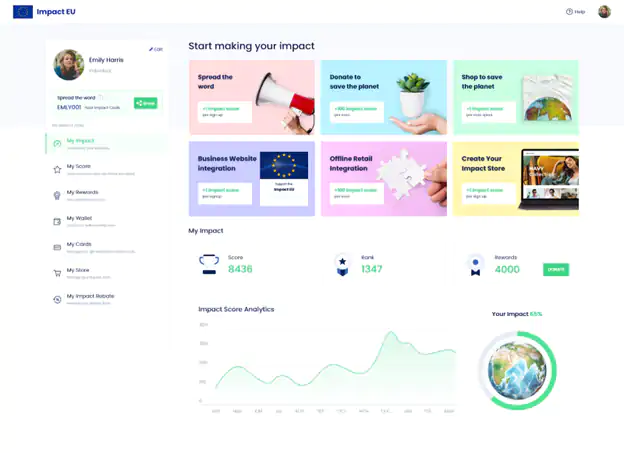

The impact of IMPT will push the world into a greener future. It will allow individuals to reduce their carbon footprints and provide a social incentive for crypto companies to offset their emissions.

The crypto industry is a notorious polluter due to the sheer amount of energy used to mine the blockchain.

IMPT will provide the industry with a method of cleaning up their carbon emissions and helping the world become more sustainable.

One of the great features of the project is the Social Platform, which will provide the first global scoring system to help projects measure their environmental impact. This social platform will incentivize individuals and businesses to become more environmentally conscious and will help them showcase their positive impact on the environment.

Why are Investors Flocking to IMPT?

The presale for IMPT is currently underway, and it’s already managed to raise well over $13 million.

Investors are piling into this presale after learning about the world-famous global brands joining the Shopping Platform.

Brands such as Puma, The North Face, Netflix, Samsung, and Microsoft are affiliates of the Shopping Platform.

These affiliates have allocated a specific sales margin for environmentally friendly projects, such as IMPT. When a user purchases the Shopping Platform, this margin is held in their account as IMPT until they have enough tokens to swap for a carbon credit.

The Shopping Platform helps the world become greener without consumers having to change their shopping habits.

IMPT continues to affiliate with more world-famous brands each week and is helping the presale to sell out quickly

Visit IMPT Presale

Silks – Replicating an Annual $11 Billion Industry.

Silks is a play-to-earn derivatives-based metaverse that mirrors a real world that generates up to $11 billion in bets each year – thoroughbred horse racing.

Silks is the world’s first derivatives-based P2E game that bridges Web3 to the real world. It’s creating a secondary economy from a flourishing ecosystem that performs well during all market conditions – including recessions – which is why it should undoubtedly be on your radar before it opens doors to its metaverse in 2023.

Four primary categories of NFTs power the Silks ecosystem;

- Silks Avatars

- Silks Horses

- Silks Land

- Silks Stables

The Silks Avatars serve as your access pass to the metaverse and allow you to start collecting in-game rewards. They also allow you to mint one of the Silks Horses each year.

The Silks Horses are the cornerstone of the ecosystem. These are NFTs that are derived from real-world living thoroughbred horses. The system records stats onto these NFTs, and you are rewarded in the Silks metaverse if you own the winning horse in real-world races.

The team estimates that winning Silks Horses NFT holders will earn up to 1% of the real-world prize purse. Considering that the prize purses in US races reach as high as $3 million – 1% is not too shabby. Furthermore, the 1% is expected to increase gradually each year.

In addition to the prizes won from winning Silks Horses, the asset’s value is also expected to surge. The NFT is a derivative of a real-world horse that typically has an average auction price of around $60,000. Horse owners then spend a further $40,000 yearly to feed, train, and house the horses. Considering their high value, it’s not a stretch to assume that the value will stretch far beyond the mint cost for the NFT – especially if you own one of the winning horses. If the derivative can attain even 5% of the underlying asset, holding one of the Silks Horses will become a very profitable endeavor.

Why are Silks Gaining So Much Attention?

Silks are quickly gaining traction in the NFT space. The Silks Avatars have been consistently ranked in the top-10 sports NFTs on OPENSEA since the first batch was released earlier this year;

The NFTs were quickly bought by top-tier investment firms and collectors of very prestigious NFT collections. You’ll find Silks Avatars in wallets alongside holders of Bored Ape Yacht Club NFTs;

The Silks Avatars are also listed on the Top 50 Gaming Index from Nansen.ai, which is often considered the most respected index in the NFT industry.

Although the first batch of the 10,000 Silks Avatars is sold out, there is still an opportunity to buy some of the final Silks Avatars for 0.25 ETH. However, the last batch is also quickly selling out. Once they’re gone, your only option to participate in the Silks metaverse is purchasing an avatar on secondary markets, such as OpenSea.

Buy a Silks Avatar Today

Conclusion

The year hasn’t been pretty for cryptocurrency or the overall economy.

Combining global macroeconomic pressure such as war and inflation with the collapse of crypto empires – it makes sense to anticipate Bitcoin heading to the next significant psychological level at $10,000.

It’s unlikely that we will see Bitcoin recovering before touching $10,000, so it’s always best to place hedges against the bearish market.

The projects listed above are fantastic hedges for the bearish pressure and will likely see exponential growth heading into 2023.