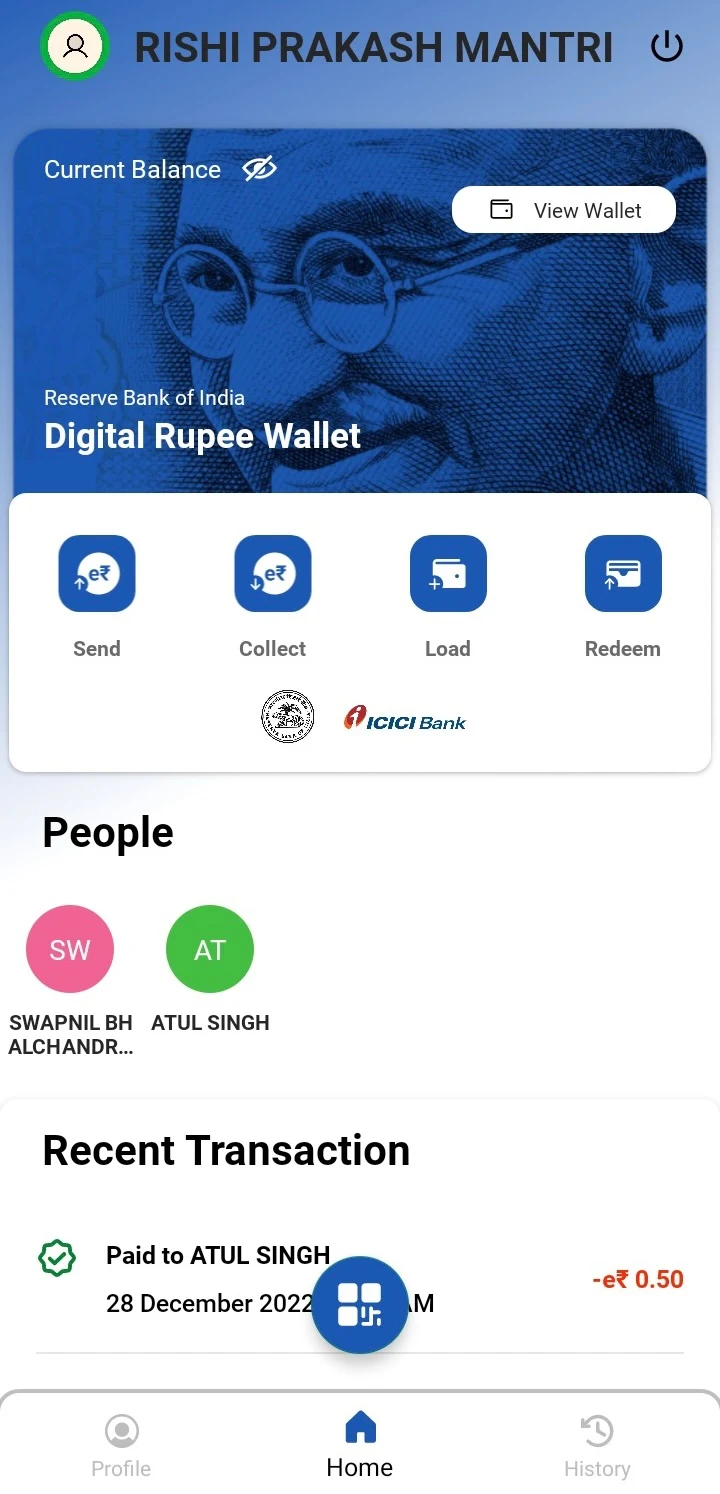

Anand Mahindra, an Indian billionaire and a board member of the Reserve Bank of India, bought some pomegranates from a street vendor by paying with Digital Rupee.

The payment itself was straight forward, just a scan of a QR code, but underneath we are led to think there has been some big leap in technology.

Not least because India is one of the first to launch a central bank digital currency (CBDC). These new inventions were thought to potentially even transform banking, but they are now implemented in a very tamed form.

The aim is for the e-rupee to be digital cash, but in practice that ambition seems to be non-existent.

This CBDC uses the blockchain, we’re told. e-CNY does not. They planned to initially, but in the end their plan changed so much that it no longer made sense to.

Likewise for the e-rupee, if it does indeed use a blockchain, we can’t see much of it.

Rather than numbers and letters, the rupee wallet seems to be more only letters.

There’s not private key as such, but a password instead is used.

Payments are not to addresses, but to names.

So on the surface, this does not quite look like crypto and underneath it is quite different too.

There are two aspects, wholesale and retail e-rupee.

The central bank is liable for the wholesale rupees which it gives to commercial banks through account based systems, so the same way as in rupees with no blockchain here.

The commercial banks then provide access to the public through a wallet that looks pretty much like a bank account.

You do not need a bank account, both the e-rupee and the e-CNY claims, but there is no other way to access this digital cash than through these banks, no self-custodian wallet.

For the e-rupee, they do not provide technical details in regards to the blockchain, but it appears to be operating the same as e-CNY which does not have a blockchain anyway.

The e-rupee is a token for the public with its own serial numbers and is issued in cash dominations, so notes of 1, 5, 20.

In theory you can withdraw this digital cash from the bank to your own wallet, same as actual cash, but in practice you need a bank app for now, so you can’t.

For CNY, they have developed offline hardware wallets, potentially getting you out of the banking system, but that’s for small amounts.

Anonymity for small payments, but transparency otherwise, is their moto. Neither specifies just what exactly is small, but we can assume it is in the hundreds rather than thousands.

e-Rupees themself do not attract any interest. They do for commercial banks if they deposit them with the central banks as for rupees they attract such interest, but not for the public even though in theory they have an account with the central bank.

In practice however they don’t. The central bank is liable only for the wholesale rupees. The retail e-rupees then are basically bank money.

They have not added interest because they claim it would be disruptive to the banking system as the e-rupee may then actually be attractive.

The possibility of giving interest to the public however was one of the main conceptual attraction when CBDCs were first discussed, with Fed researchers suggesting it may address the interest problem.

That is money is created with an interest burden for the borrower, the government and the public, both of whom bear the cost of this money creation through inflation, and don’t see benefits as only banks can charge interest on the loans.

The initial conceptions of CBDCs however are now a different world as their implementation is now more basically the same as for ordinary fiat.

No one other than banks have access to the central bank, banks act as gatekeepers for the public, and rather than cash this is digital bank money save for a small amount eventually.

Some theories that suggest commercial banks are becoming mere licensees of central banks and they are stealthily being nationalized, therefore, are outdated.

Because the e-rupee is just rupee really. Since the central bank does not give accounts, surveillance and the rest is compartmentalized like with bank money. The only potential difference here being that for a small amount it can be like cash in as far as you can hold it yourself digitally without needing a bank, but the sums implied are more pocket change.

The Indian central bank does not hide the fact their main aim with this is to make crypto less attractive.

They even claim in some of their statements that this is like crypto, when that’s not quite the case because we have not quite seen a block explorer yet, to say nothing about the fixed limit.

Some even claim there’s programability, but that’s a different sort than Solidity at least so far, and more how you can program credit card payments through APIs.

So a big step forward? Well, more banks trying to fool the public while not giving the public an inch, but how do they compare with stablecoins?

CBDCs vs Actual Crypto Fiat

The CBDC discussion as far as we are concerned was closed by the Swedish central bank in circa 2018 when they pointed out the tech aspect is easy, they can do it on the blockchain as well, but the political ramifications were potentially considerable.

From total surveillance to commercial banks no longer quite existing in money creation to the same extent, an actual crypto CBDC potentially would be even a matter for a referendum.

But current CBDCs have nothing to do with crypto unless you want to be very literal in interpretation in as far as they might use some cryptography somewhere.

Instead they are window dressing except as stated for very small amounts they can eventually be like cash once they do launch actual self-custody wallets.

So far however, from the perspective of this space, they’re useless. You can’t put it on an eth smart contract, you can’t insta transfer it like USDc, and so it’s not really cash so far but bank money.

USDc is cash however, to some extent, and once Fed backs them as they have to with it just a matter of timing, it will be cash to a full extent.

But, not many countries have the privilege of a USDc or USDt adoption. In fact no country does except USA.

An Australian big four bank is launching an AUD stablecoin, and in defi especially other non-dollar stablecoins have the potential of taking off.

This could be one way of other money getting in the actual game. We’ve previously suggested a witty move for small money in this context, like the pound, might be for the Bank of England to frontrun and announce they back it, but a bank issuing it is pretty much the same.

An interesting question is whether these e-moneys are another way of getting into the game. Whether they are in effect a systemic stablecoin.

The way they are being implemented however leaves a lot to be desired because they are extremely restrictive when compared to stablecoins.

The Reserve Bank of India for example says and quite explicitly that they want control, that they don’t like disruption, and defi is not cool as far as they’re concerned.

The problem however is nobody cares about their preferences. There’s a dollar stablecoin eating the world and nobody else is getting in the game and that can develop into a problem.

For e-CNY for example apparently $13 billion has been put in circulation, yet we feel zero effects from it and comments from Chinese users are that it is nothing, no different than bank money.

That’s because they’ve been designed to be very much similar to bank money, a ruse.

A CNY stablecoin however would be different as anyone would be able to hold it or defi it, wherever in the world.

The West therefore is a bit lucky that they like control so much because the market of course doesn’t like control, yet breaking into this market for Europe in particular has proven difficult.

The extra difficulty they have is that US can do whatever they do to get a competitive advantage to spur adoption.

One way for example is to give interest in such Euro stablecoins. That would be a desperate move in some ways, and US might even allow them for sometime because a blockchain forex market may well be to the benefit of most.

It is not clear however central bankers are clear eyed on this matter. While those from the Fed, at least some within their ranks, have shown forwardness, ECB is neutral at best and more less than neutral, while RBI vibrates hostilness.

This bias may blind them to the opportunities. A new code based financial system is being built. It is still nascent, but in banking and in finance only laggards now have any bad thing to say about it.

This new system won’t replace central banking or banking, at least anytime soon, let alone governments as RBI says in one of their last decade today statement.

But it will update them or complement them in some ways. Crypto fiat money is one such way, and central bankers – especially those that see crypto as competition, should love it.

Governments in our view should also see it as some sort of a national interest matter. The United States, for now, is taking all global commerce in crypto fiat, all.

For perspective, about $350 billion was moved on-chain through bitcoin this month so far. The numbers for stablecoins are in the billions too.

If cryptos 10x, these numbers will start being a noticeable proportion of actual fiat. Still small, maybe 5% or 10%, but those billions may become trillions.

Central banks therefore, especially outside US, and governments, when looking at crypto fiat, need to do so with very clear eyes and less from a competitive perspective and more from an opportunity perspective.

The opportunities, for a country like Britain especially which is small but can have big impact, and for the Euro, are immense because crypto fiat is fiat, but with smart contracts and blockchain.

That means it is available to anyone across the world and it is particularly useful – outside of crypto trading – in crisis struck countries where a safe store of value is needed.

This sort of crypto fiat can have an impact, and for the dollar it does because it arose out of the market to meet market needs.

Why e-money should have any impact however is not clear, especially the way they are designed which seems to be uniform across central banks.

Maybe it makes some systems better under the hood, but it is not global money, like stablecoins, and it is not interoperable with crypto.

Many therefore lost interest long ago, but stablecoins are a hot story in geopolitics with this being for countries in many ways what their internet strategy, or often lack of it, was in 1995.

Just like then, Europe in particular risks being left behind in this specific point because the market has not propelled a euro stablecoin, which means it might need some sort of a push.

The Australian way maybe is it, but a euro based crypto exchange, perhaps like BitPanda, offering seamless conversion from euro to eurob might make a dent.

Failure to do so gives the dollar total dominance and in years to come, that might prove costly.

Rather than focusing their efforts on these CBDCs therefore, which are a closed matter where serious people are concerned, countries need to seriously start asking themselves what is their crypto strategy.

Because we are past the stage where skepticism or worse, hostility, is understandable. We are instead more at the stage of which country will keep up and even wondering whether one of them might leap so far to the point of domination.