The Bank of England reportedly reject Revolut’s banking license application over concerns around its information technology (IT) systems.

The bank’s Prudential Regulatory Authority (PRA) said last week that it planned to issue a warning to Revolut in March after reviewing its initial application. Negotiations to rescue the application are underway after the PRA didn’t follow through on its warning.

Revolut Maintained Flawed Financial Controls, Says License Authority

The PRA initially cited concerns around Revolut’s balance sheet after the fintech underwent an audit.

Financial services firm BDO found problems with how Revolut’s IT system assured its revenue streams. The accounting firm flaws in the system meant it could not verify $540 million of Revolut’s revenue, including income gleaned from crypto trading

Revenues gleaned from crypto trading comprised one-third of the firm’s fees in 2021.

A U.K. ejection will prevent the firm from offering mortgages and customer loans.

The U.K.’s Financial Conduct Authority (FCA) has taken a hard-line stance against crypto firms offering services to citizens. Consequently, many firms have bypassed U.K. registration and offer services remotely.

The U.K. government blames regulators for Britain’s anti-entrepreneurial reputation.

Treasury Minister Jeremy Hunt this week that U.K. competition authorities must consider economic growth after they rejected Microsoft’s intended takeover of gaming giant Activision Blizzard.

How Regulators Are Learning to Embrace Fintechs

While fintechs started distinct from the banking system, offering shiny interfaces that moved money rapidly at a fee, newer fintechs want to be a one-stop solution for all financial needs.

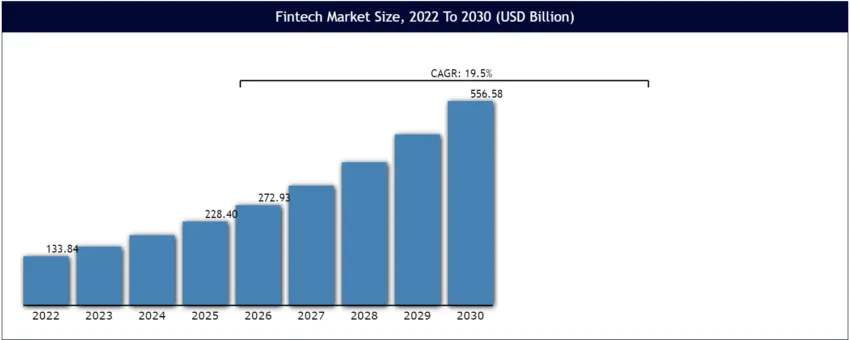

According to Vantage Research, the global fintech market was worth $133.8 Billion in 2022.

Revolut is also seeking a banking license in Australia, which already offers multi-currency business accounts and other fiat and crypto services.

The Australian Prudential Regulatory Authority granted its first restricted banking license to an online bank in 2018 amid criticism it favored Australia’s big four of Commonwealth , National Australia Bank, Australia and New Zealand Banking Group, and Westpac Banking Corp.

A restricted license allows limited banking business two years before full prudential compliance is required.