A branch of the California District Court has granted the American tax collecting body, the Internal Revenue Service (IRS), permission to issue a John Doe summons on the crypto exchange giant Kraken – in a bid to discover the identities of United States residents and citizens who have conducted high-value crypto transactions in the past four years.

The IRS is known to have been hoping to gain a favorable court ruling for several weeks, if not months. The move follows a warning last month from a tax expert – who wrote, prophetically: “Guys, file your crypto taxes. The IRS is coming” – after the tax body won the right to issue a John Doe summons on Circle.

A John Doe summons, in the IRS’ own words, permits the tax body to “obtain the names, requested information and documents concerning all taxpayers in a certain group.”

Per an official release from the American Department of Justice (DoJ), the IRS now has the power to force Kraken to reveal information about United States taxpayer customers who conducted USD 20,000 or more worth of crypto transactions in the period 2016 to 2020.

In the release, David Hubbert, the acting Assistant Attorney-General of the Justice Department tax division, stated:

“Those who transact with cryptocurrency must meet their tax obligations like any other taxpayer. Gathering the information in the summons approved today is an important step to ensure cryptocurrency owners are following the tax laws.”

And the IRS Commissioner, Chuck Rettig, stated that there was “no excuse for taxpayers continuing to fail to report the income earned and taxes due from virtual currency transactions.” He called the summons “part of our effort to uncover those who are trying to skirt reporting and avoid paying their fair share.”

The tax body claimed that its petition did not suggest that Kraken “has engaged in any wrongdoing in connection with its digital currency exchange business.”

However, the DoJ report added that the summons was on the hunt for information connected to the IRS-led “investigation of an ascertainable group or class of persons” that it “has a reasonable basis to believe” may have “failed to comply” with tax rules.

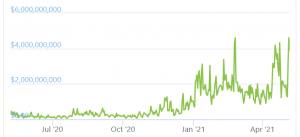

Daily trading volume on Kraken:

____

Learn more:

- South Korean Crypto Tax U-Turn Looking Unlikely, Despite Outcry

- Take My Fiat but Don’t Sell My Crypto, Plead Millionaires after Tax Bust

- 'Guys, File Your Crypto Taxes, the IRS is Coming'

- Collect Taxes More Effectively to Avoid ‘Debt Trap’ Chaos, Warns IMF