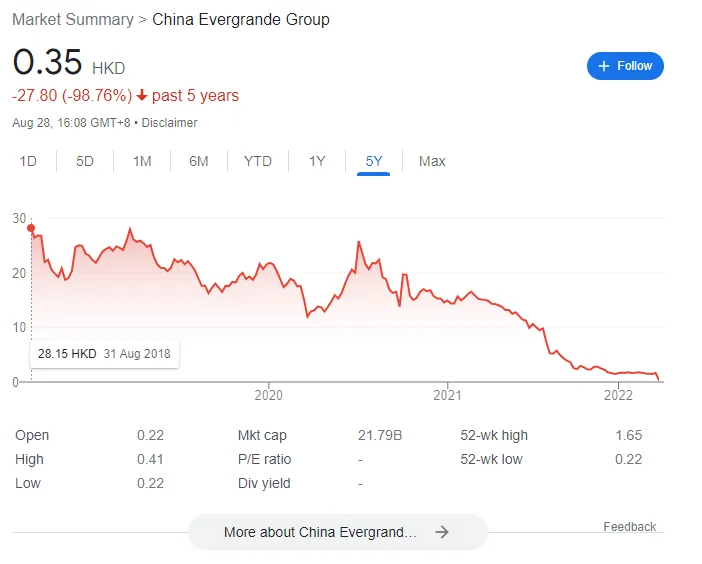

In an unsettling revelation for the financial markets, China Evergrande Group’s shares experienced a drastic fall inIts stock price dropped as much as 87% in Hong Kong following a 17-month trading hiatus.

Once boasting a valuation of over $50 billion in 2017, the beleaguered property giant’s market cap dwindled to a paltry $586 million, making it a penny stock.

Evergrande Shares in the Bargain Bin

The nosedive to HK$0.35 highlighted Evergrande’s tumultuous journey from its zenith. In the recent disclosure to the Hong Kong Stock Exchange, the developer, grappling with a drawn-out debt restructuring, reported a staggering loss of 33 billion yuan for the half-year ending June 30.

This adds to its 582 billion yuan loss over the prior two years and also marks the first such annual loss since its debut in 2009.

Intensifying the cloud of uncertainty hovering over China’s most significant restructuring efforts, the defaulted developer chose to defer the scheduled creditor meetings until late September. Evergrande stressed the importance of allowing its creditors to comprehend the terms and implications of the proposed schemes.

The company maintains that enhanced internal systems and controls have met the criteria stipulated by the Hong Kong listing rules. But, the resumption of trade has also highlighted the grim reality. From its peak, Evergrande’s market capitalization has eroded by a staggering 99%.

Beyond its financial woes, Evergrande’s predicament epitomizes the broader housing crisis plaguing China, the world’s second-largest economy. The stringent regulatory crackdown to curb risks and make housing affordable has inadvertently impacted numerous developers.

Dovey Wan commented on the situation,

As China’s third-tier cities struggle with substantial financial shortfalls, a state of fiscal austerity takes center stage.

What’s to Come?

The financial disclosures also paint a grim picture: Evergrande’s H1 net loss tallied at 39.3 billion yuan. This loss stems primarily from soaring operating costs, litigation-related losses, and impairments on property projects. By June’s end, its staggering liabilities totaled 2.39 trillion yuan, eclipsing its assets, which amounted to 1.74 trillion yuan.

Its borrowings witnessed a marginal uptick to 625 billion yuan. There was also a significant surge in its payables to suppliers, which reached a whopping 1 trillion yuan. As Evergrande pledges a commitment to delivering homes, the number of under-construction residences saw a decline of 19%. And its cash reserves dwindled to a mere 13.4 billion yuan.

Read more about another financial crisis happening in 2023: 2023 US Banking Explained: Causes, Impact, and Solutions

recent note, Bloomberg Intelligence analysts Kristy Hung and Lisa Zhou warned that the persisting cash crunch, unlikely to be alleviated by the resumption of trading, threatens not just Evergrande’s project completion but also China’s broader housing recovery.

They predict that,

“Buyers may stay sidelined until the pricing trend turns around, setting a tone for a negative feedback loop.”

Offshore bondholders now find themselves in a waiting game, with the next month clarifying the firm’s debt restructuring proposition. Amid this financial turmoil, the firm’s new auditor, Prism, refrained from offering a conclusion on the interim earnings report, citing multifaceted uncertainties.