Litecoin (LTC) price has dropped to $89, down 18% from its recent peak of $115 recorded on July 3. Long-term investors have started selling as fears of the perennial “Halving doom” rears its head again.

LTC has a much-publicized historical trend of retracing drastically in weeks leading to a Halving event. With only a week to the August 2 estimated Halving date, bearish fears have gripped the Litecoin ecosystem.

Litecoin Long-Term Holders Have Started Selling

In a big to front-run the much-publicized Litecoin “Halving doom,” LTC long-term holders appear to have started offloading their coins. Indicatively, the Age Consumed data compiled by Santiment has shown several spikes this week.

Age Consumed is derived by multiplying the number of recently traded tokens by the number of days since they were last moved. This essentially tracks the current trading sentiment long-term holders among long-term holders

As observed above, persistent spikes in Age Consumed means long-term investors are selling more of their holdings, which can often have a negative impact on price.

Fears of a post-halving price crash could see more investors pile on sell pressure in the coming days.

Read More: Litecoin (LTC) Price Prediction 2023/2025/2030

Traders are Pililing up Sell Orders as Fears of the Halving ‘Doom’ Grows

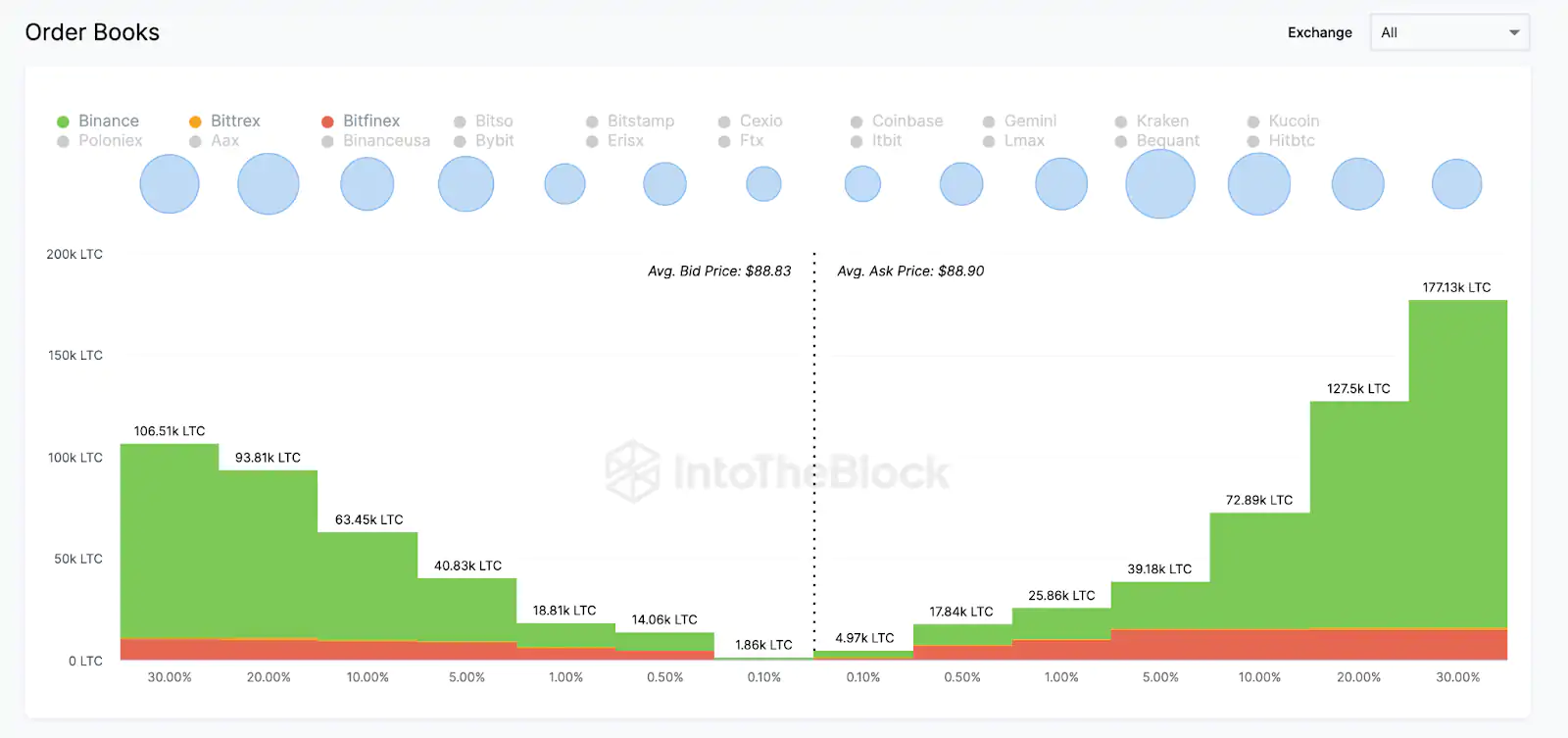

In further confirmation of the growing fears of Litecoin Halving doom, LTC sell-orders have outpaced buy-orders across various crypto exchanges. According to the Exchange On-chain Market Depth chart below, supply has exceeded demand by a considerable margin.

As things stand, crypto traders have put up 465,000 LTC coins for sale. This is disproportionately higher than the current active buy-orders of 339,000 LTC.

Exchange On-chain Market Depth shows the price distribution of the active buy and sell orders placed across various exchanges. When the side is significantly higher than the side, as seen above, it indicates impending sell-pressure

Currently, there is a market surplus of nearly 126,000 LTC. Such a high volume excess supply typically puts downward pressure on the price of an asset. Traders could lower their asking prices to get their orders filled quicker.

Considering Litecoin’s price corrections during the 2015 and 2019 Halving events, these ongoing fears could trigger another post-halving price crash in August 2023.

Read More:Top 9 Telegram Channels for Crypto Signals in 2023

LTC Price Prediction: The $85 Support is Critical

IntoTheBlock’s GlOM data shows that LTC could enter a larger price correction if it loses the initial $85 support level. However, the 570,000 addresses that bought 2.18 million LTC at a minimum price of $85.99 could pose a formidable first line of defense.

Nevertheless, if the towering sell-wall remains unmoved, then LTC could drop further toward $80.

Yet, the bulls could invalidate the “halving doom” projection if they can trigger a rebound above $95. However, 1.13 million investors had bought 16.64 million LTC coins in that territory. As the Litecoin halving sparks fears, they could panic and try to exit their positions once they break even.

But if that does not happen, Litecoin could reclaim the $100 milestone once again.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits