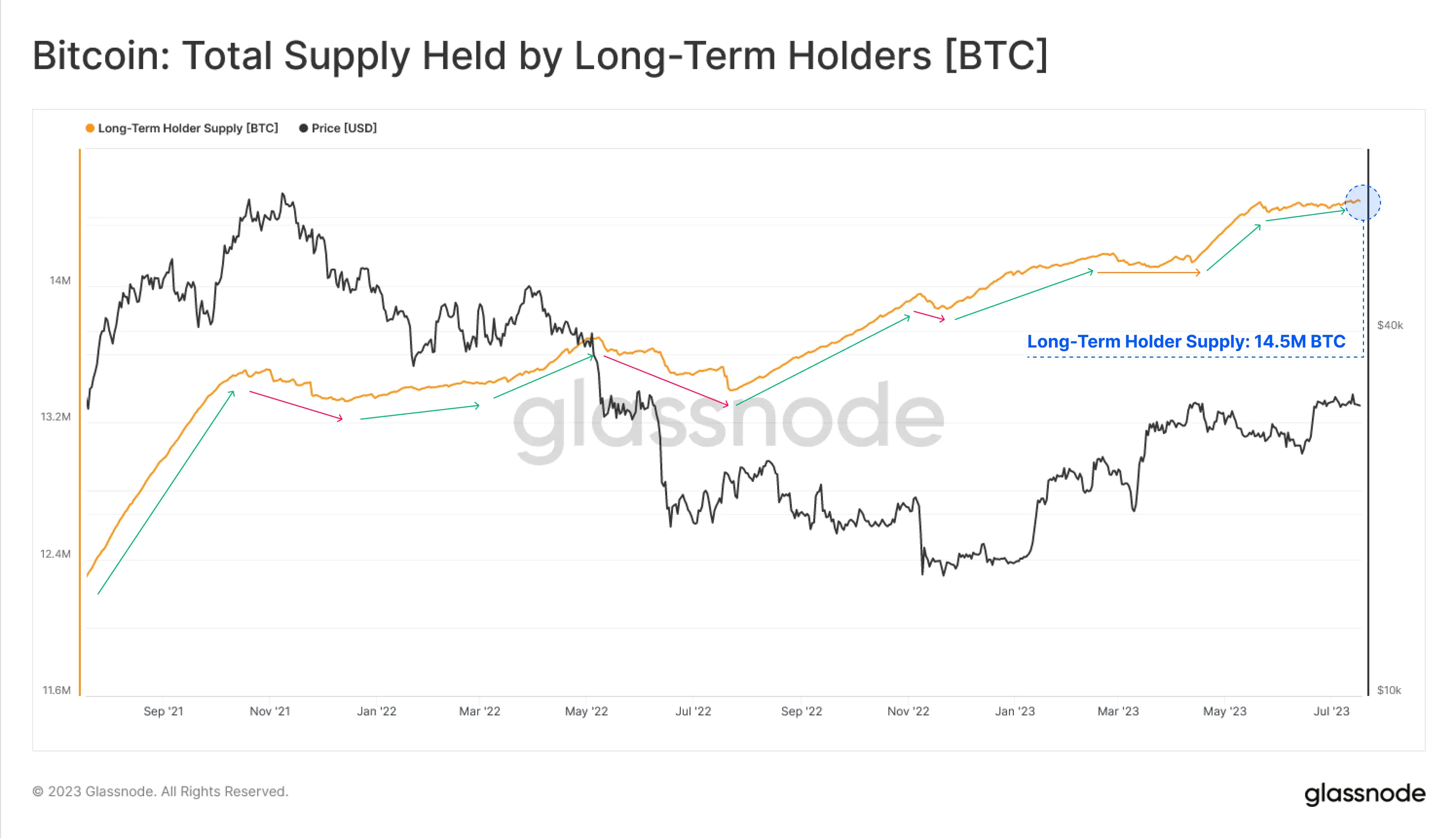

The fact that the Bitcoin Long-Term Holder Supply is at an all-time high of 14.5 million BTC indicates a significant trend among mature investors: they are increasingly inclined to accumulate Bitcoin rather than distribute it. This observation carries important implications for the cryptocurrency market and reveals a growing confidence and long-term perspective among seasoned Bitcoin holders.

Bitcoin Viewed As A Store Of Value

The preference for accumulation by mature investors signifies a shift towards viewing Bitcoin as a store of value and a potential long-term investment rather than a speculative asset. This sentiment aligns with the evolving narrative around Bitcoin, where it is often compared to digital gold due to its limited supply and potential to act as a hedge against inflation and economic uncertainty.

Increasing Institutional Adoption

One possible explanation for this behavior is the increasing institutional adoption of Bitcoin. Traditional financial institutions, hedge funds, and corporations have begun to recognize the potential of Bitcoin as a hedge and an alternative asset class. This institutional interest has contributed to the perception of Bitcoin as a legitimate and valuable investment especially with the launch of Bitcoin ETFs applications, which has attracted more long-term holders.

Furthermore, the maturity of the Bitcoin market itself plays a role. As the cryptocurrency ecosystem has evolved, it has become more robust and secure. This growing stability and the establishment of regulated exchanges and custodial services have instilled confidence in investors, making them more comfortable with holding Bitcoin for extended periods.

Lastly, the continuous growth of the Bitcoin Long-Term Holder Supply suggests that experienced investors are increasingly accumulating Bitcoin rather than distributing it. This trend reflects a shift towards viewing Bitcoin as a long-term investment and store of value, driven by institutional adoption, growing market maturity, and the recognition of Bitcoin’s potential as a hedge against economic uncertainties.