We’ll be looking at where MicroStrategy stores its $BTC, among other related topics.

Where Does Microstrategy Own Bitcoin?

Simply put, where is that huge stack of $BTC being stored? Back in 2022, rumors arose that all of the company’s $BTC was held in 2 addresses. However, we can disprove this quickly. Indeed, we can just copy both addresses and paste them over to a block explorer, like Blockstream. Lo and behold! As of today, both addresses hold a sum of less than 0.03 $BTC. That’s less than USD $800!

So, we can safely conclude that these 2 wallets aren’t holding the company’s treasure chest. Both of these could have been old and used wallets. But they aren’t in use now. As of April 5th, 2023, the company holds a total of 140,000 $BTC. But where exactly? No one, except probably Michael Saylor, knows.

Yet, what we do know is that the company takes the security of its $BTC storage very seriously. I mean like, who wouldn’t? It’s only $4.17 billion dollars, right? We know the team is using multiple custodians to hold its $BTC. But, we just don’t know who they are.

Is Microstrategy a Good Buy?

Next, you could be wondering: “Is $MSTR a good investment?”. Before we move on, we would just like to state some facts. First, we’re not financial consultants. Second, we do not offer investment advice. Only just educational information.

Another point to note. $MSTR is NOT a cryptocurrency. It’s a share of stock in a company. So, you can’t buy it on BINANCE or Kucoin, like how you buy $BTC. Once you’ve digested that, let’s take a brief look at Microstrategy’s stock ($MSTR).

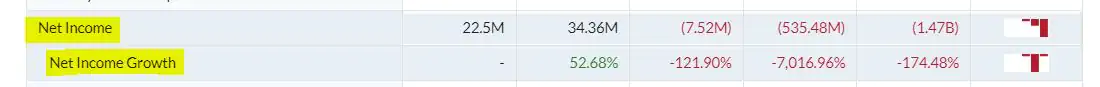

Usually, for stocks, you need to Do Your Own Research (DYOR) before you hit the buy button. The same goes for cryptos as well. But, for stocks, you’ll have to look at the company’s financial performance. Refer to the screenshot below, which represents Microstrategy’s net income for the past 5 years. Note that the left shows data for the year 2018 and the right for the year 2022.

From the above, you can see that the net income has been dropping. It hasn’t been a good past 3 years for the company.

On top of that, the company isn’t doing too well in managing its debt. To make matters worse, it hints at selling $BTC to cover its debt payments too. If its software analytics business cannot cover its debt, it raises questions about the sustainability of its business.

Of course, the above are just 2 points relating to $MSTR. In stock analysis, you’ve got to do your own research (DYOR) more than just that. This is to arrive at a reasonable conclusion before buying the stock. But, such research is too wide to be covered in the scope of this article.

Does Microstrategy Mine Bitcoin?

Just as Michael Saylor is bullish on $BTC, he appreciates $BTC mining too. Indeed, he feels that it’s a profitable use of energy. That’s a debatable point amongst many, especially among environmentalists. But, that’s a discussion for another day. What we can agree with Saylor is this: Bitcoin’s Proof-of-Work (PoW) consensus has proved to be a viable economic model.

#Bitcoin Mining serves as the foundation of the monetary network – critical to its growth, stability, longevity, vitality, & integrity. The Proof of Work architecture is a masterpiece of engineering that anchors the system to the real world, providing Seven Layers of Security.

— Michael Saylor?? (@saylor) May 13, 2021

Let’s get to the main point. Does Saylor or his business mine $BTC? In short, as far as we know, the answer’s no. Or, we don’t know if they do. But, this does not diminish Saylor’s influence on the Bitcoin and crypto space.

We’ve come to the end of our two-part article series on Microstrategy. To keep tabs on its developments, follow its Twitter account . You should also follow Saylor on his Twitter too. He does tweet quite often, and his influence on Bitcoin is undeniable.