CoinShares, Europe’s biggest digital asset trading and investment group, has blamed FTX for a collapse in its income.

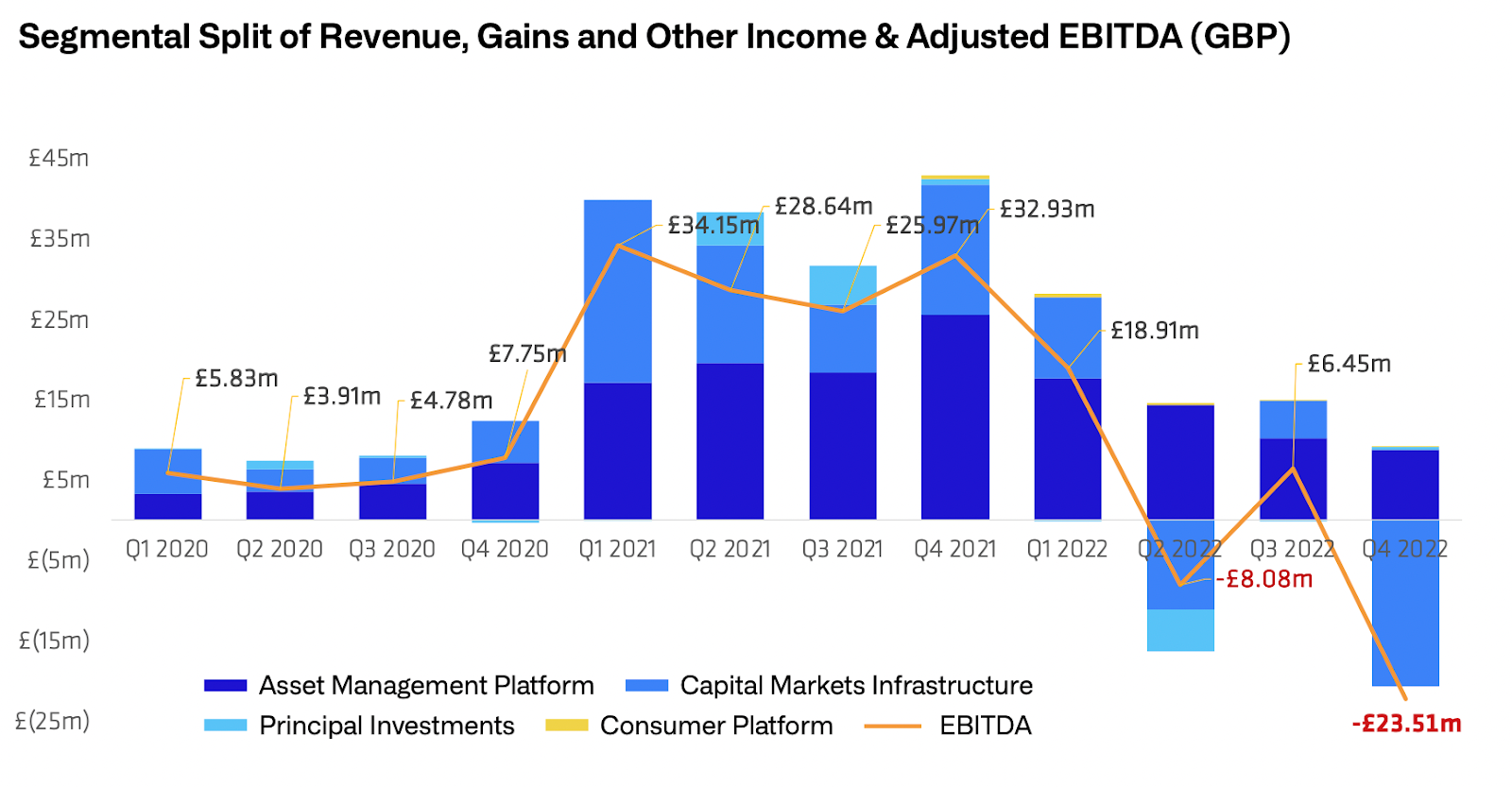

The group published in fourth quarter report on Tuesday which revealed that the fund’s total comprehensive income has tanked by more than 97%. Income in 2021 was ?113.4 million ($136 million), however, by 2022, it had crashed to just ?3 million ($3.6 million).

According to Investopedia, comprehensive income is the net income plus the value of unrealized profits (or losses) in the same period.

The company’s revenue also declined by nearly 36% from ?80.8 million ($96 million) in 2021 to ?51.5 million ($62 million) in 2022.

The fallout from the FTX collapse has also impacted on several hedge funds. For example, the Galois Hedge fund announced that it was shutting down its operations yesterday.

CoinShares was operating at a profit in Q3 2022, but had approximately $31 million tied up with FTX.

The CEO is Optimistic About Future

CoinShares’ Chief Executive Officer Jean-Marie Mognetti believes that the company is financially robust despite the turmoil in the market. He concludes that the firm closed the year successfully by getting on Nasdaq Stockholm.

The CEO predicts more institutional investors will explore crypto before the next halving. He writes, “2023 will be a year of restructuring, consolidation, and development for the industry and consequently for CoinShares. We anticipate the arrival of institutional players in the second half of 2024 as regulations in Europe, the U.S., and the U.K. come into force. It will also coincide with the next Bitcoin halving cycle.”

Got something to say about CoinShares or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on FacebookTwitter